At its monthly meeting Monday, August 21, DISD Board of Trustees unanimously voted to call for a $11.255 million bond election and a voter-approval tax ratification election (VATRE) for Tuesday, November 7, 2023.

What is a VATRE?

VATRE stands for Voter Approval Tax Ratification Election. A VATRE is triggered when the school board adopts a Maintenance and Operations tax rate above the compressed rate. The compressed rate is .6970 cents and the board adopted a rate of .7270 cents which is three cents higher than the compressed rate.

The DISD tax rate that is on the homeowner’s tax statement consists of two board-approved tax rates, M&O and I&S. M&O stands for Maintenance and Operations, and the funds are used for the daily operations of the district, including salaries, supplies, and minor building repair and maintenance. I&S stands for Interest and Sinking, and the funds are used to pay off voter approved bonds.

Why did the board approve an M&O tax rate higher than the compressed rate?

Starting in 2019, the state began compressing the school tax rate by reducing DISD’s M&O tax rate by 17 cents, which were voter-approved pennies. The first eight of these pennies are called “golden pennies.” (They are called golden pennies because, if voter-approved, they can be leveraged, or used, to garner more state funding.) At the time, the school board was able to adopt a resolution allowing the district to retain five of these golden pennies. The voters must approve the three golden pennies still remaining; therefore, the board approved the tax rate at three cents higher than the compressed rate in order to trigger an election to ask the voters for approval. These three pennies will generate approximately $202,097 from the local property taxpayer, which will then be leveraged to receive an additional $746,369 in funding from the state. Additional funding is automatic if the voters approve the additional three cents. If voters do not approve adding these three pennies, then the district does not get the additional state funding.

If I vote in favor of the VATRE, how much will it cost me?

If the voters approve the three pennies, the M&O tax rate would go from the compressed amount of .6970 cents to .7270 cents. To figure your cost, take the appraised value of your home minus exemptions, divide by $100, then multiply the result by .7270. If the homestead exemption stays at $40,000 and you have a house valued at $100,000, then it would look like this:

($100,000 – $40,000)/$100) X .7270 = $436.20/year for 2023.

While it is true that this is $18 per year higher than the compressed rate, it is still $76.56 less than what the taxpayer paid in 2022. If the homestead exemption is increased to $100,000 by voter approval, the homeowner in this scenario would pay no school taxes (please see tables at the end of this article). While the district cannot guarantee that voters will approve the $100,000 tax exemption, historically, voters have approved increasing the exemption. In 1997, voters approved an increase by 77.5%; in 2015, by 86%; and in 2022, by 89%.

Why is the board calling for another bond election after the voters said “No” in May?

Funding sources for the identified capital improvements are only available through voter-approved bonds. Proposition A on the May ballot was defeated by only 39 votes. Because the state is compressing the tax rate and asking the voters to increase the homestead exemption, the district has a unique opportunity to attain funding that will increase salaries, make capital improvements for the safety and security of all campuses, while still reducing the tax rate.

If approved, what projects will be funded by the $11.255 million dollar bond?

If approved by the voters, this bond election proposition will give priority to improving the safety and security of DISD campuses. In the fall of 2022, the district formed a facilities committee with over 40 community members, parents, teachers, and business owners. This committee met over the course of three months to identify and prioritize district-wide improvements. The committee recommended that the board call for a $32.2 million bond election to address these improvements. The district administration, along with input from staff and community members, will re-evaluate the proposed projects from the May Bond election to determine how to best utilize the funds to maximize the safety and security of our campuses.

If the $11.255 million bond is approved, how will my personal taxes be impacted?

The tax rate will not increase if the bond election is approved. The I&S (interest and sinking) portion of the school tax rate is used to pay off voter-approved bonds. This portion of the school district tax rate is decided on by the board of trustees based on the amount of money required to make the yearly bond payment. There will be no increase to the current 24 cent I&S tax rate as it is sufficient to fund the entire $11.255 million proposed bond.

However, your tax bill is determined not only by the school district tax rate, but also by the valuation of your home. The school tax rate will go down, but your property tax bill could increase because of increased appraised values.

What will be on the ballot in November?

The school will have the Bond Election and the VATRE as two separate propositions on the ballot. The voters can approve one or the other, both, or none. The state will also have several constitutional amendments on the ballot, one of which is to increase the homestead exemption from $40,000 to $100,000, which would further reduce property taxes if voter approved.

How much will my taxes be affected by the passage of both the bond and the VATRE?

School property tax is calculated by taking the value of the home as appraised by the Medina or Frio County Appraisal Districts, subtracting the homestead exemption, then dividing this amount by $100 and applying the school tax rate to the result.

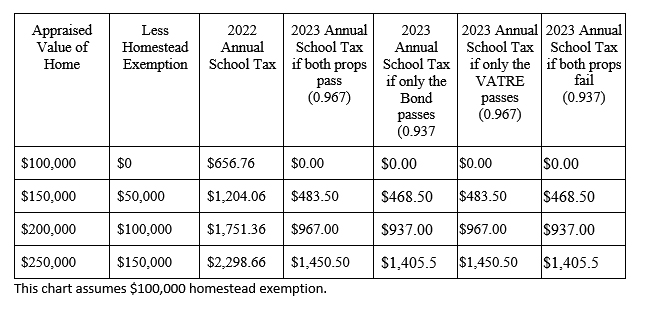

The following table shows the expected impact on school tax if both school propositions are approved and the State Constitutional Amendment to increase the Local Homestead Exemption to $100,000 is approved.

The following table shows the expected impact on school tax if both propositions are approved and assumes the Local Homestead Exemption remains at $40,000.

If you are interested in serving on a committee to help prioritize capital improvement projects, please contact the Central Office at 830-851-0795.

How will these propositions impact your taxes?

The chart above shows a comparison of how Devine ISD resident’s taxes would be impacted if both of the Devine ISD school propostitions are passed or voted down.

**These projections are assuming that the major State Constitutional Amendment to increase the Local Homestead Exemption to $100,000 is approved as well. This is the legislation that lawmakers are tyring to pass in an effort to give residents some relief from skyrocketing property taxes in recent years. There is no garauntee that the State Ammendment will pass, but it is historically, likely.