Texas public notices can be viewed here:

https://txlegalnotices.com/

At this link above, you can search for notices in The Devine News as well as other Texas newspapers.

PUBLIC HEARING – Vacate & Replat

Medina County Commissioners’ Court will conduct a public hearing on Thursday October 5, 2023 at 10:00 a.m., in the Commissioners Courtroom, 1300 Avenue M, Room 165, Hondo, TX to allow the public to discuss the application to vacate and replat Lot 51 of Lytle Ranch Subdivision, Unit 1; Located in Precinct 4 off of County Road 6816.

Jennifer Adlong

Administrative Assistant

Publish: September 13, 20 & 27, 2023

PUBLIC HEARING – Vacate & Replat

Medina County Commissioners’ Court will conduct a public hearing on Thursday October 5, 2023 at 10:00 a.m., in the Commissioners Courtroom, 1300 Avenue M, Room 165, Hondo, TX to allow the public to discuss the application to vacate and replat a portion of Lot 9-A of San Antonio Trust Subdivision; Located in Precinct 2 off of County Road 6710.

Jennifer Adlong

Administrative Assistant

Publish: September 20, 27 & October 4, 2023

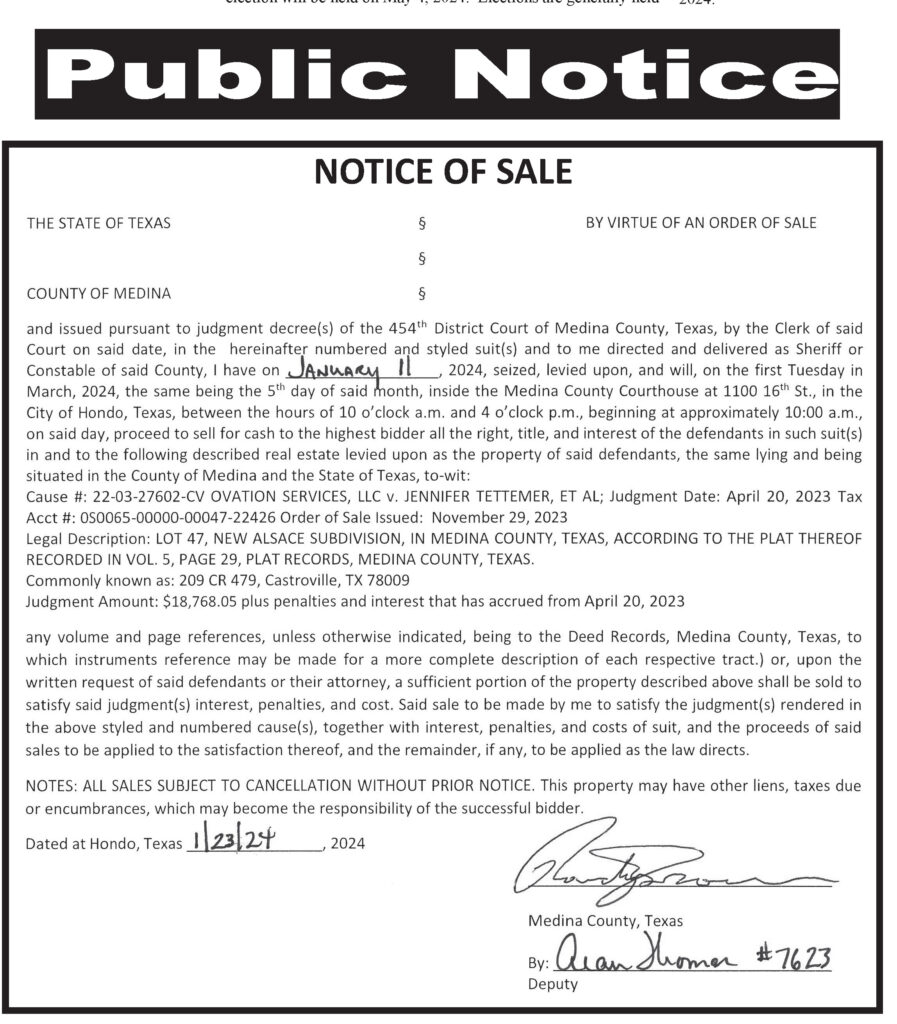

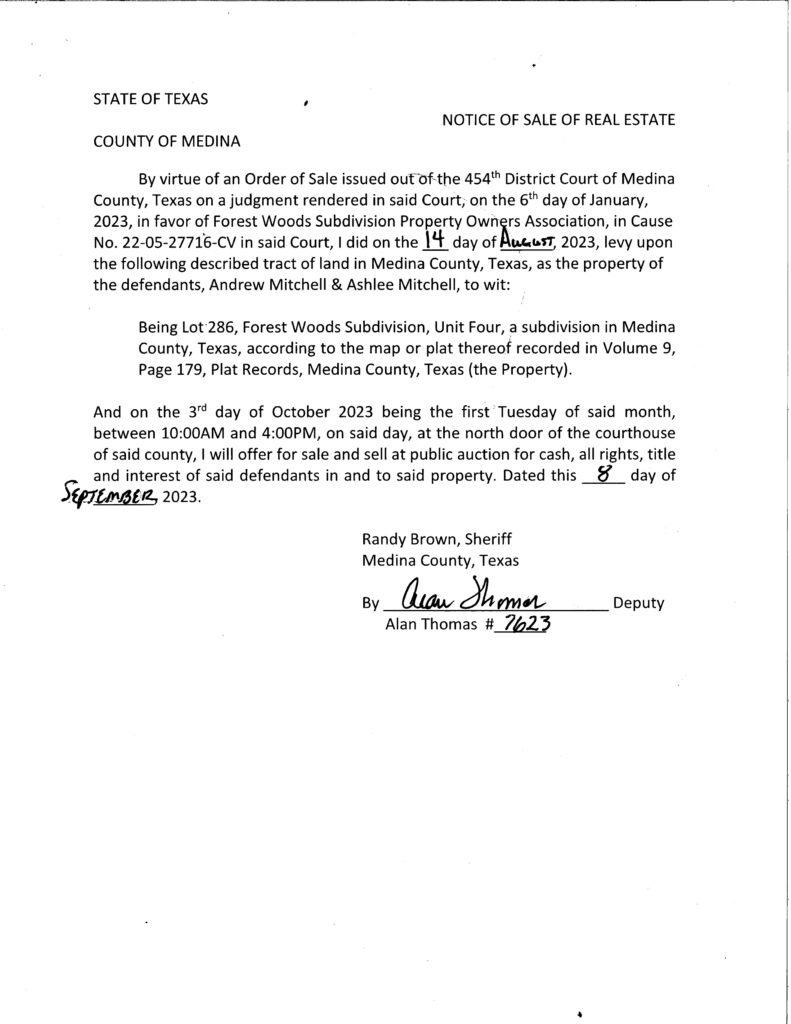

Notice of Sale of Real Estate

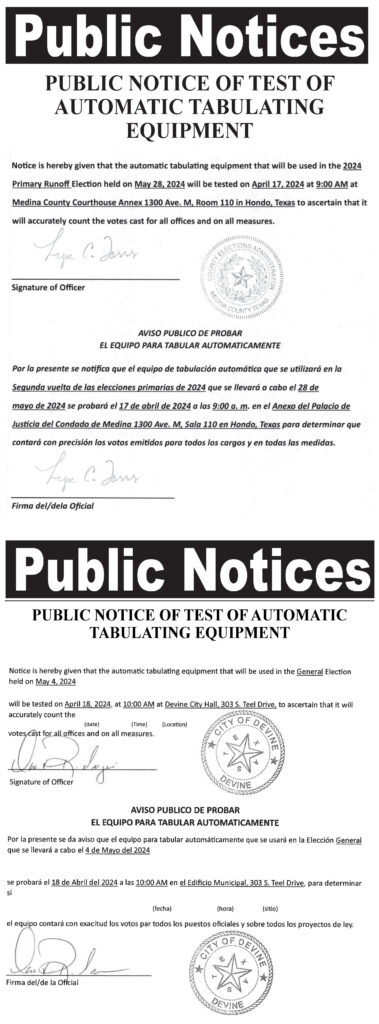

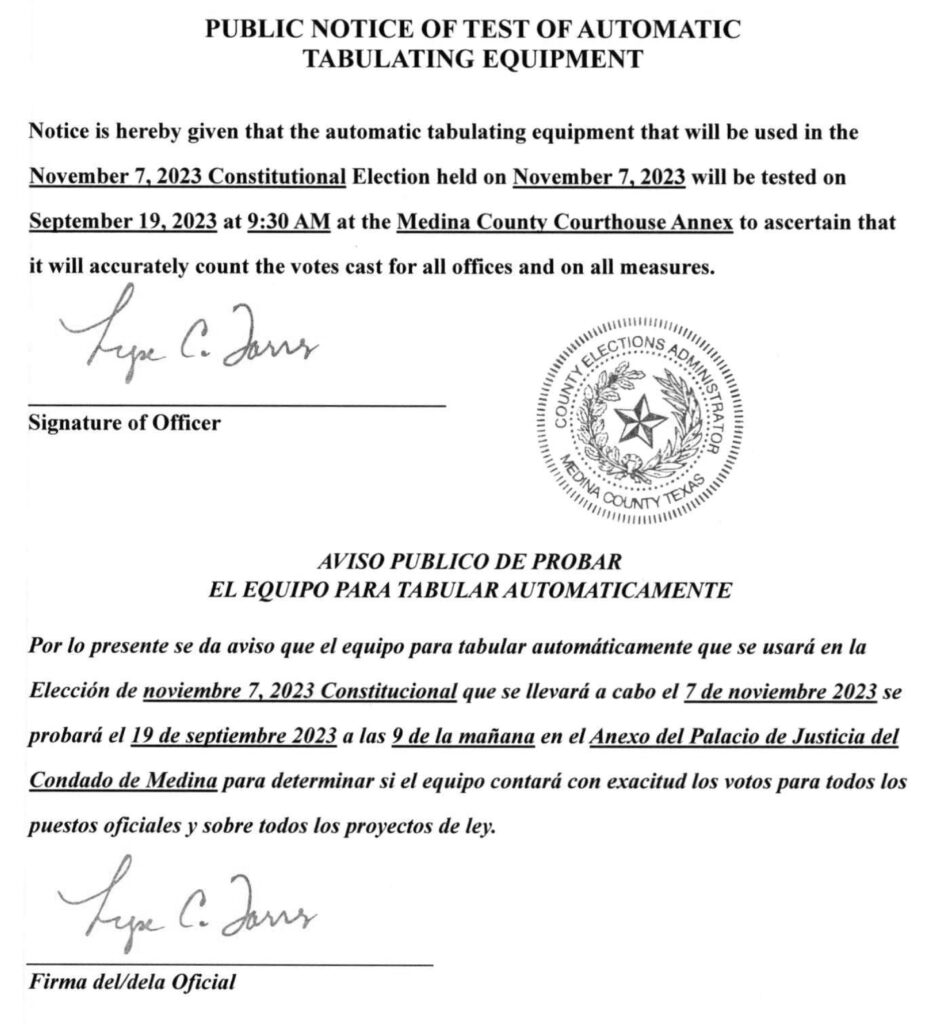

Notice of Test of Automatic Tabulating Equipment Medina County Elections

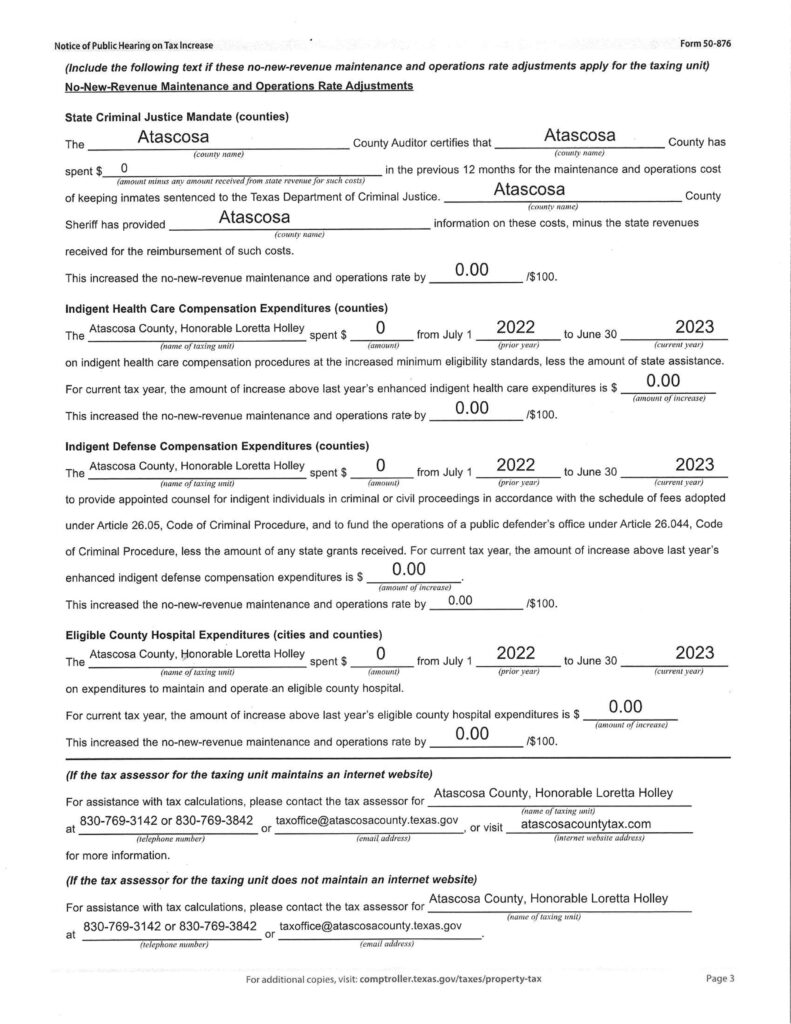

Atascosa County Small Taxing Unit Proposed Tax Rate Notice

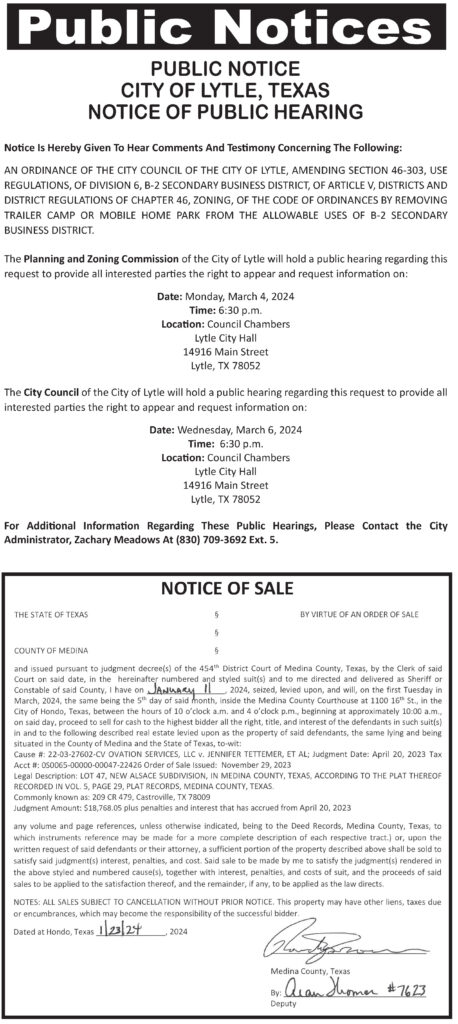

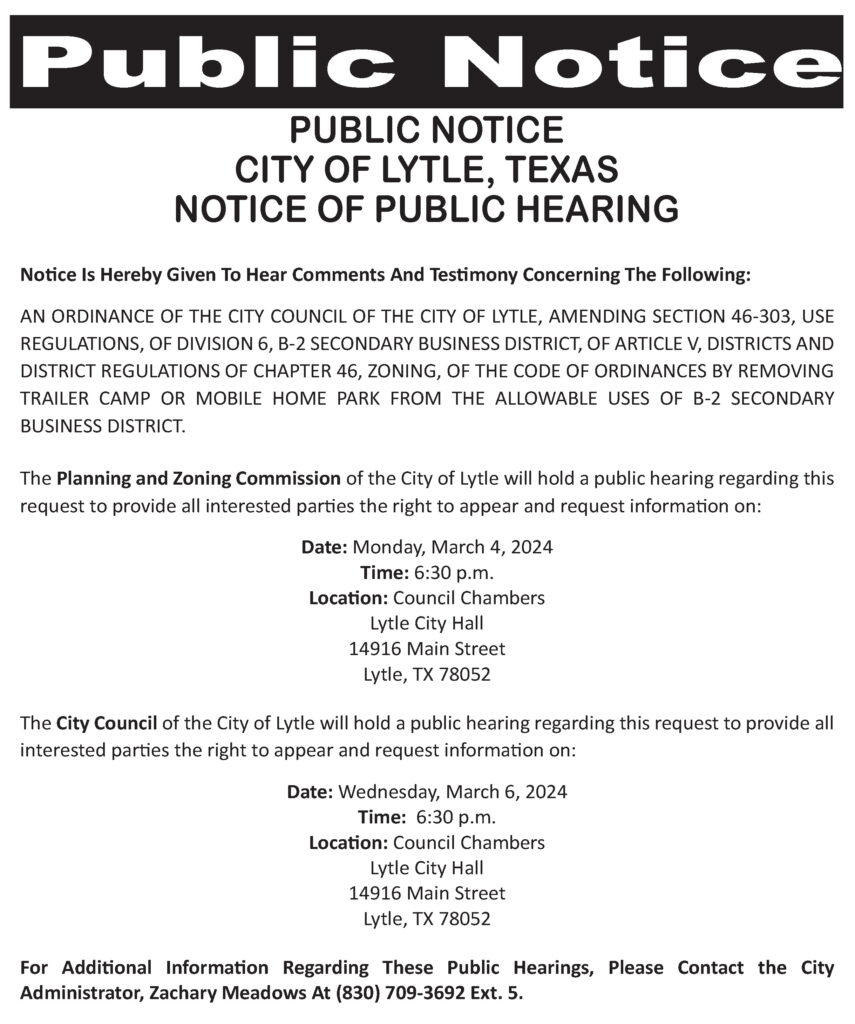

NOTICE OF PUBLIC HEARING

ON TAX INCREASE ESD #2

A tax rate of $0.0704 per $100 valuation has been proposed by the governing body of Medina County Emergency Service District # 2 (Fed. 2).

| PROPOSED TAX RATE | $0.0704 per $100 | |

| NO-NEW-REVENUE TAX RATE | $0.0686 per $100 | |

| VOTER-APPROVAL TAX RATE | $0.0704 per $100 |

The no-new-revenue tax rate is the tax rate for the 2023 tax year that will raise the same amount of property tax revenue for Medina County Emergency Service District # 2 (Fed. 2) from the same properties in both the 2022 tax year and the 2023 tax year.

The voter-approval rate is the highest tax rate that Medina County Emergency Service District # 2 (Fed. 2) may adopt without holding an election to seek voter approval of the rate.

The proposed tax rate is greater than the no-new-revenue tax rate. This means that Medina County Emergency Service District # 2 (Fed. 2) is proposing to increase property taxes for the 2023 tax year.

A PUBLIC HEARING ON THE PROPOSED TAX RATE WILL BE HELD ON September 19, 2023 AT 7:00PM AT 1419 CR 5710 Devine, TX 78016.

The proposed tax rate is not greater than the voter-approval tax rate. As a result, Medina County Emergency Service District # 2 (Fed. 2) is not required to hold an election at which voters may accept or reject the proposed tax rate. However, you may express your support for or opposition to the proposed tax rate by contacting the members of the of Medina County Emergency Service District # 2 (Fed. 2) at their offices or by attending the public hearing mentioned above.

YOUR TAXES OWED UNDER ANY OF THE RATES MENTIONED ABOVE CAN BE CALCULATED AS FOLLOWS:

Property tax amount= (tax rate) x (taxable value of your property)/100

| FOR the proposal: Jeffry Howard Ken Nighswander Todd Summers | |||

| AGAINST the proposal: None | |||

| PRESENT and not voting: | |||

| ABSENT: Brenda Butler Chris McGuairt | |||

Visit Texas.gov/Property Taxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, including information about proposed tax rates and scheduled public hearings of each entity that taxes your property.

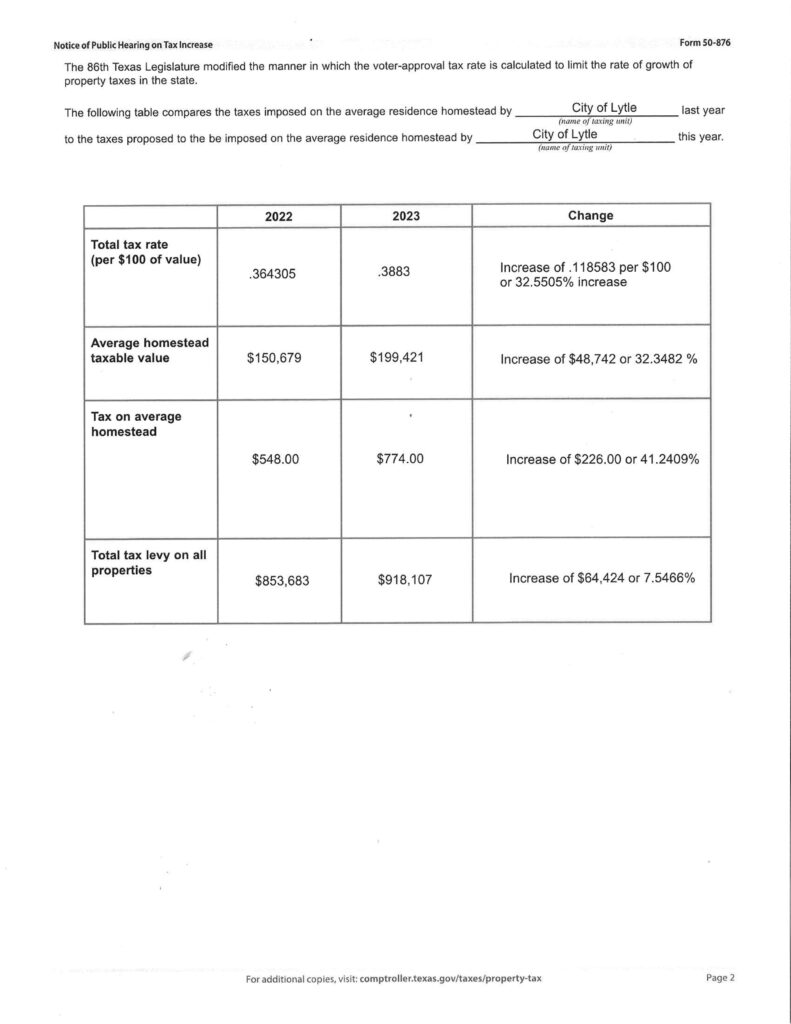

The 86th Texas Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of property taxes in the state.

The following table compares the taxes imposed on the average residence homestead by Medina County Emergency Service District # 2 (Fed. 2) last year to the taxes proposed to be imposed on the average residence homestead by Medina County Emergency Service District # 2 (Fed. 2) this year.

| 2022 | 2023 | Change | |

| Total tax rate (per $100 of value) | $0.0785 | $0.0704 | decrease of -0.0081, or -10.32% |

| Average homestead taxable value | $158,296 | $173,702 | increase of 15,406, or 9.73% |

| Tax on average homestead | $124.26 | $122.29 | decrease of -1.97, or -1.59% |

| Total tax levy on all properties | $534,728 | $561,585 | increase of 26,857, or 5.02% |

For assistance with tax calculations, please contact the tax assessor for Medina County Emergency Service District # 2 (Fed. 2) at (830)741-6100 or 1102 15th St Hondo, TX 78861, or visit www.medinacountytexas.org for more information.

PUBLIC HEARING – Vacate & Replat

Medina County Commissioners’ Court will conduct a public hearing on Thursday October 5, 2023 at 10:00 a.m., in the Commissioners Courtroom, 1300 Avenue M, Room 165, Hondo, TX to allow the public to discuss the application to vacate and replat Lot 51 of Lytle Ranch Subdivision, Unit 1; Located in Precinct 4 off of County Road 6816.

Jennifer Adlong

Administrative Assistant

Publish: September 13, 20 & 27, 2023

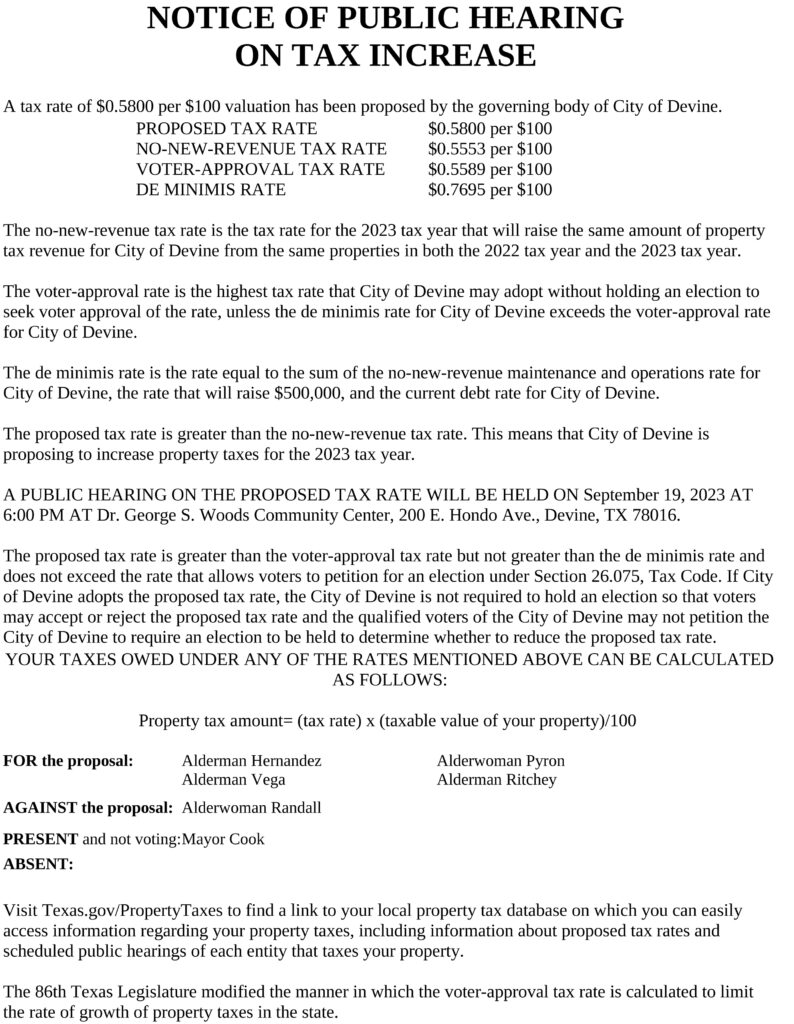

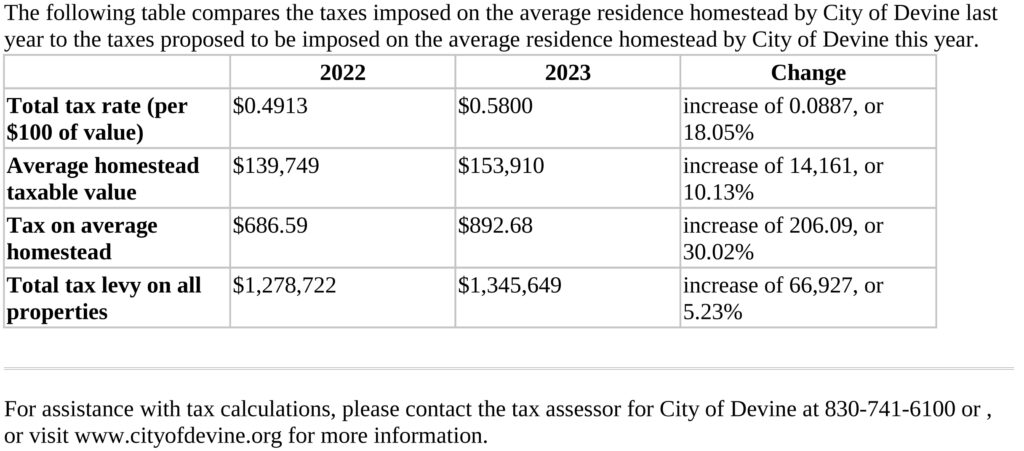

City of Devine Tax Notice – Tax increase Public Hearing Devine

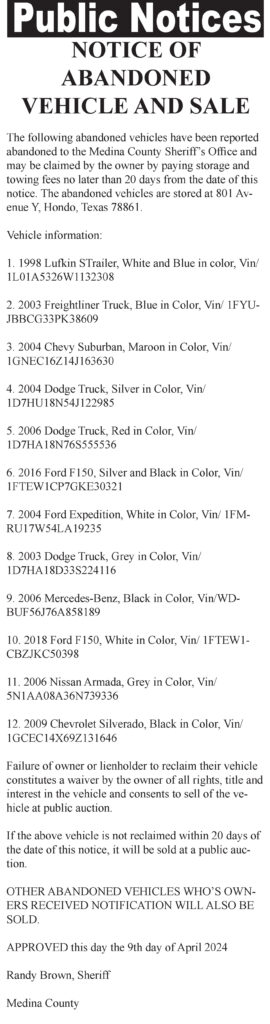

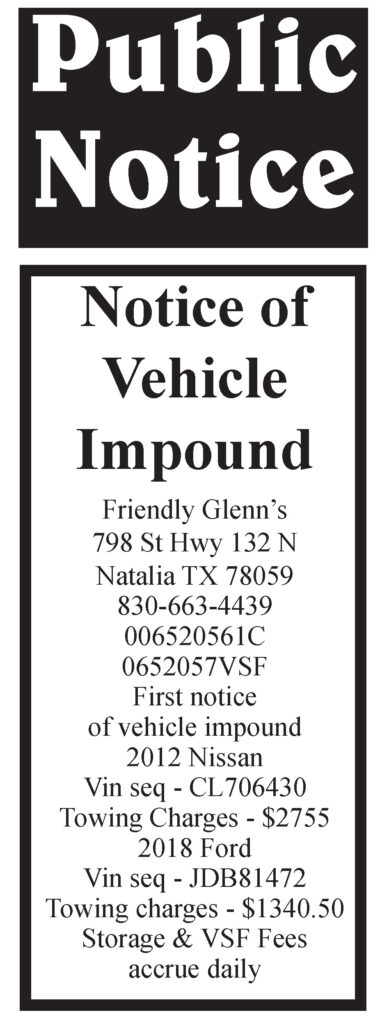

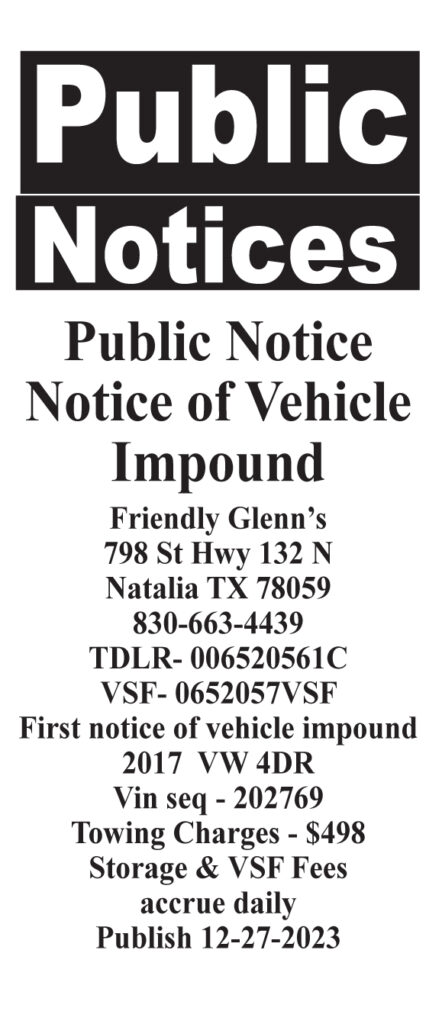

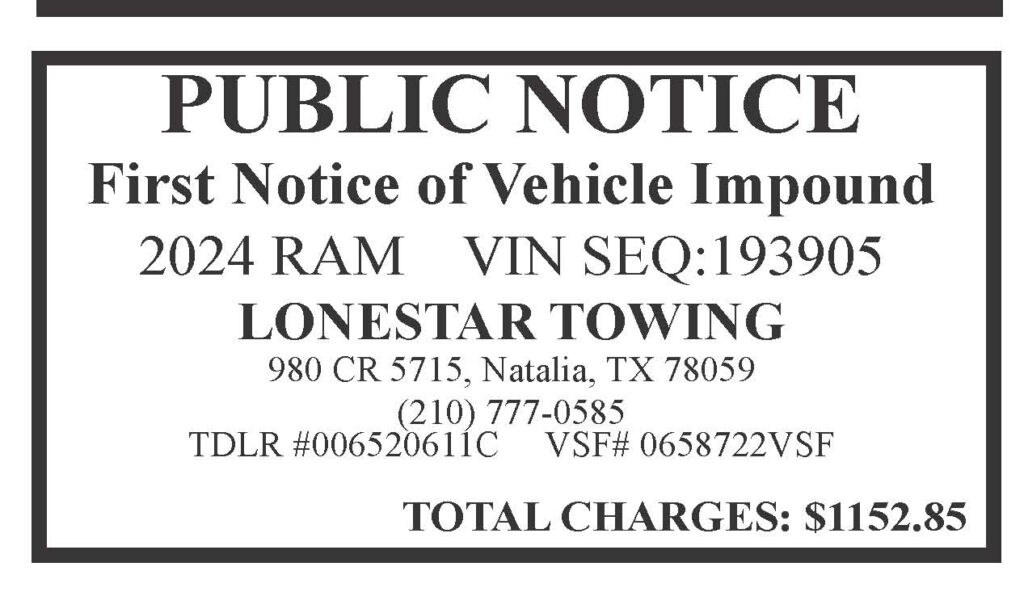

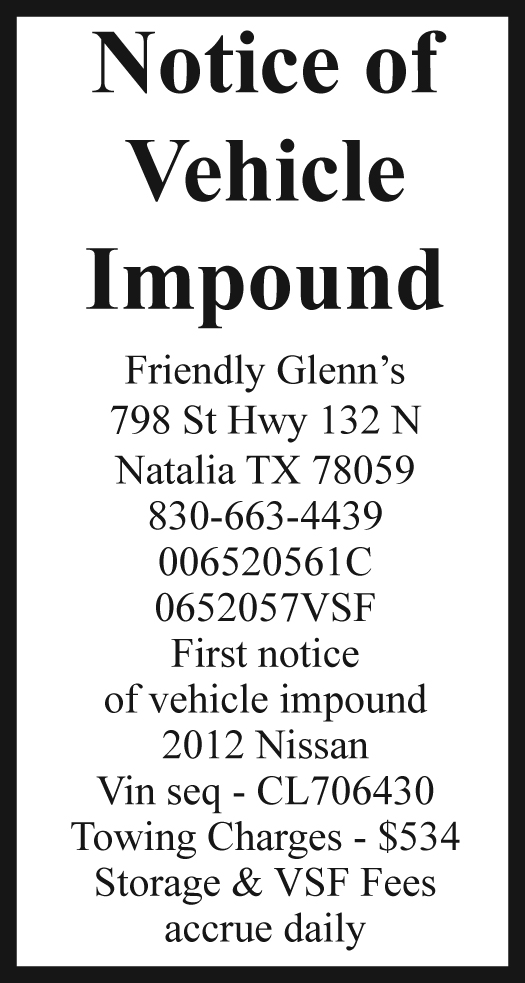

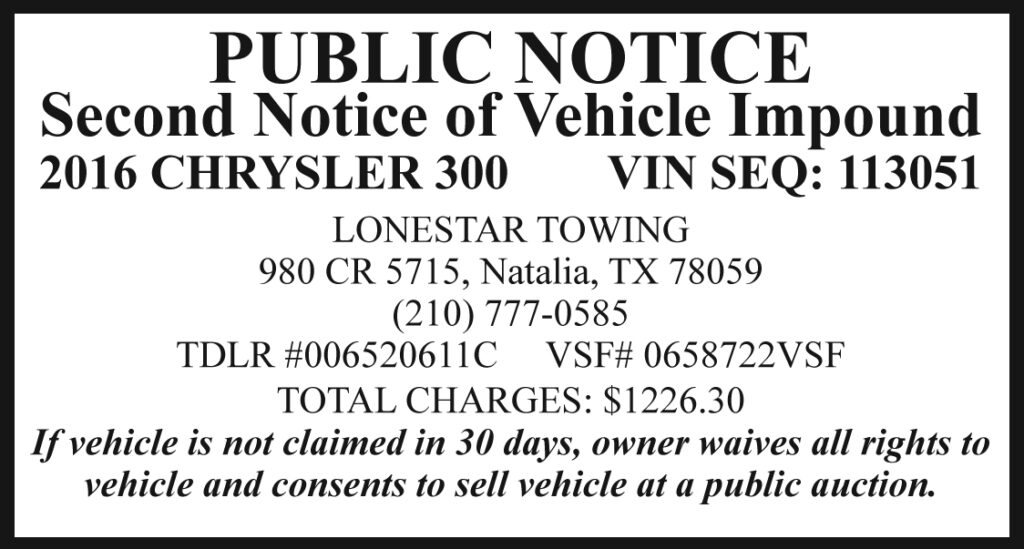

Notice of Vehicle Impoundment

Notice of Test of Automatic Tabulating Equipment Medina County Elections Office

Week of Sept 5, 2023

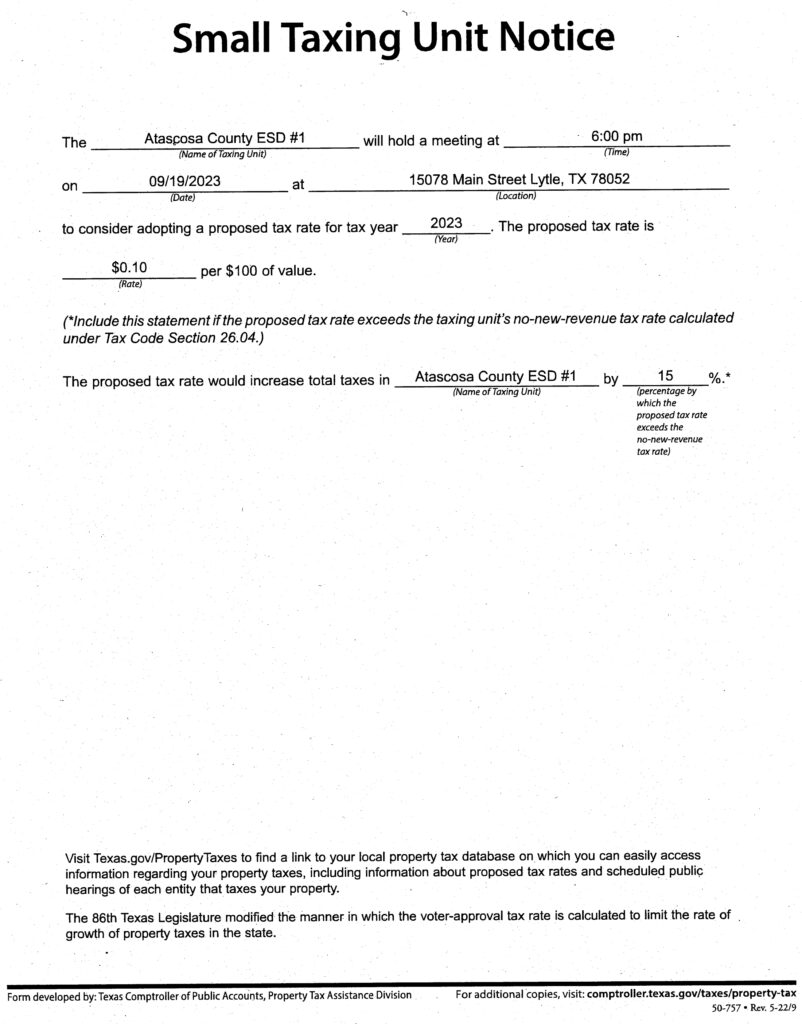

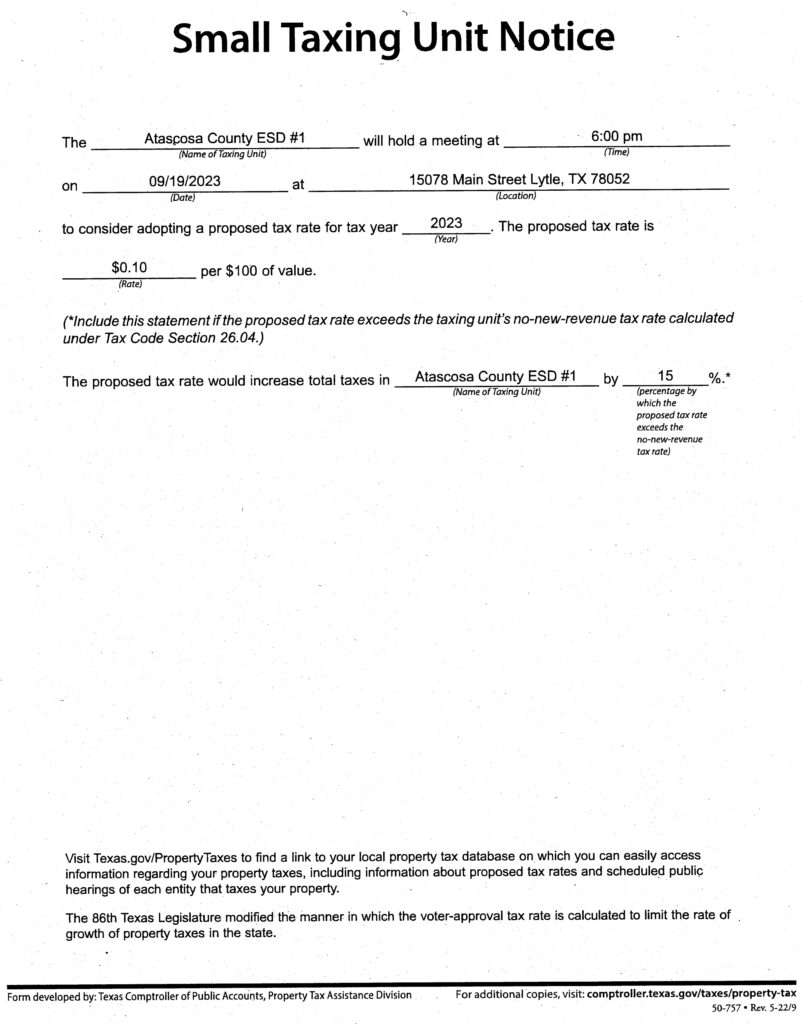

ESD #1 Atascosa County Small Taxing Unit Notice

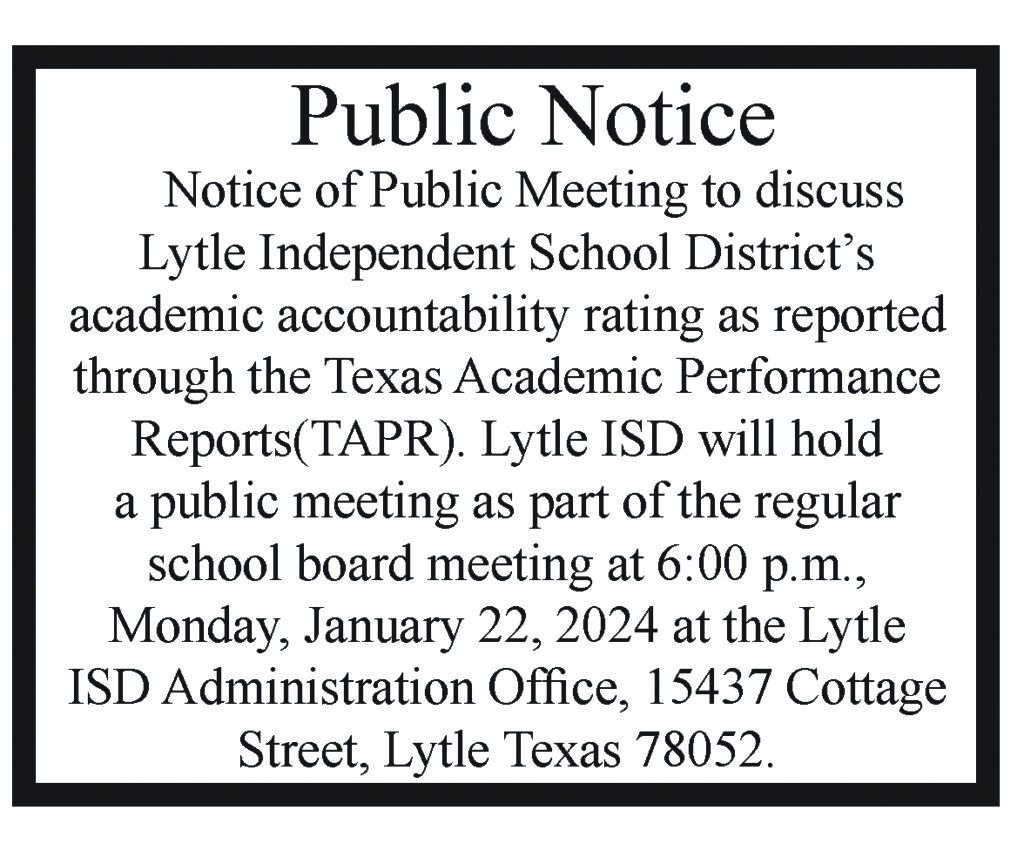

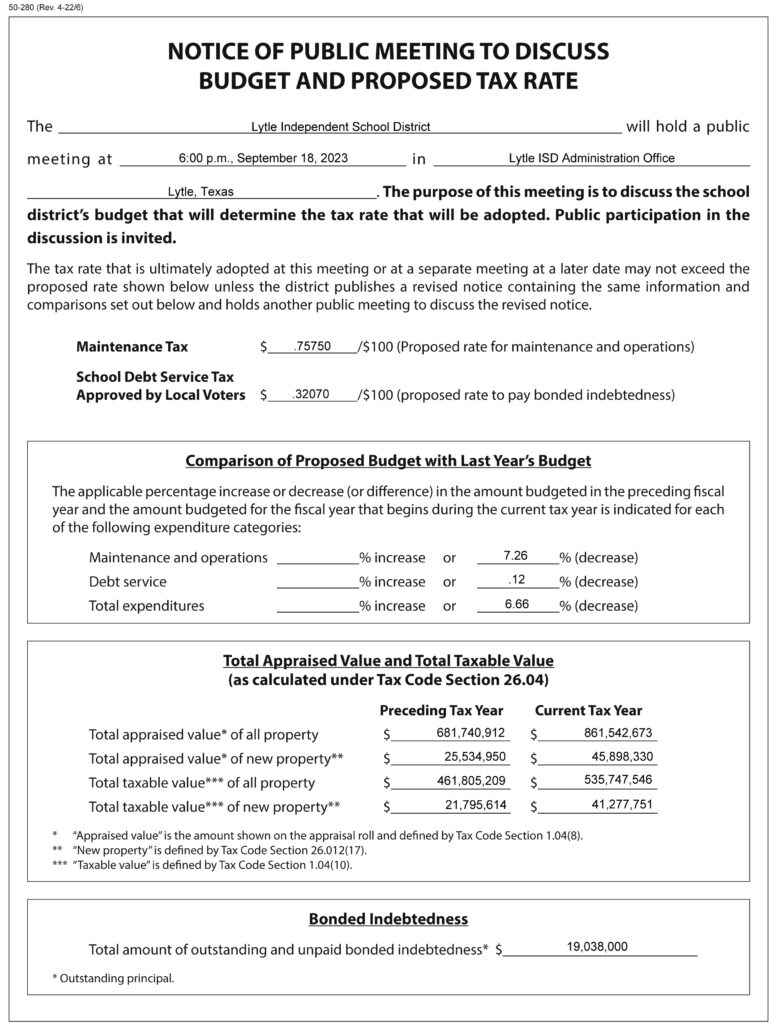

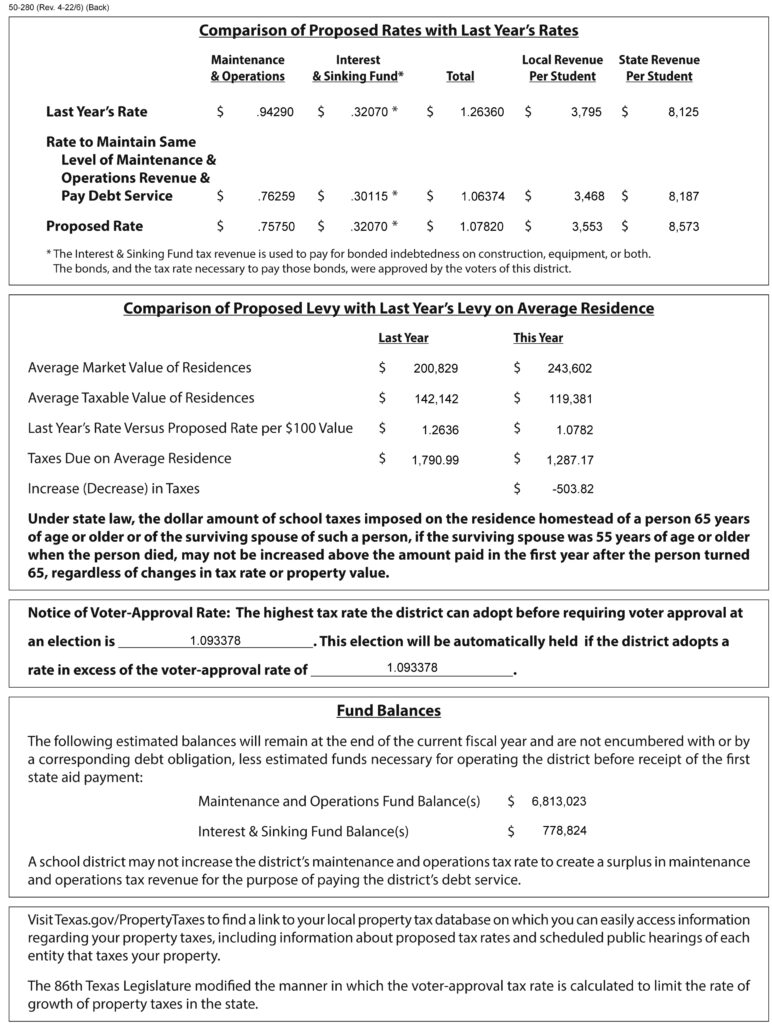

Lytle ISD Meeting to discuss budget and proposed tax rate

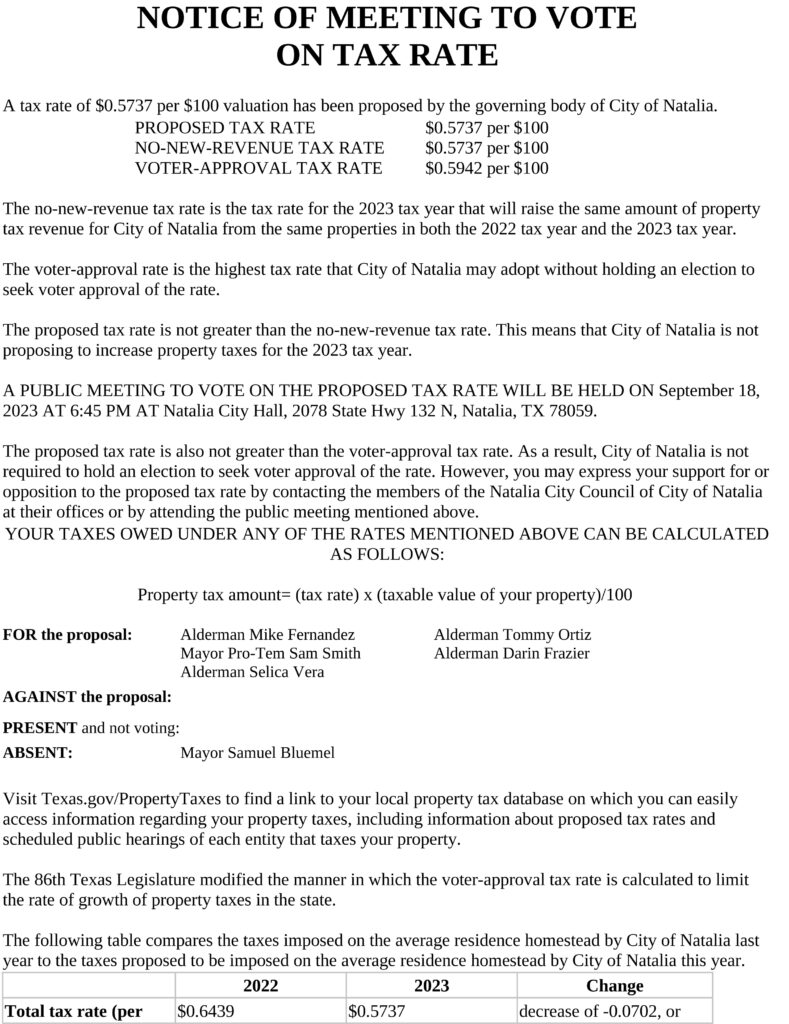

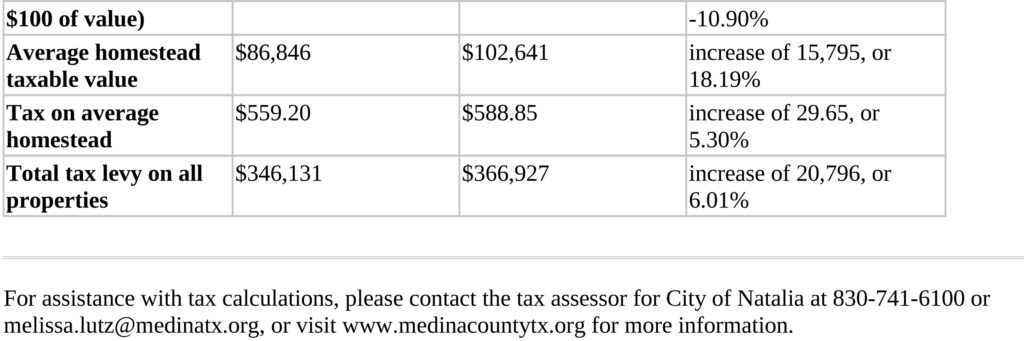

City of Natalia public hearing on Tax increase

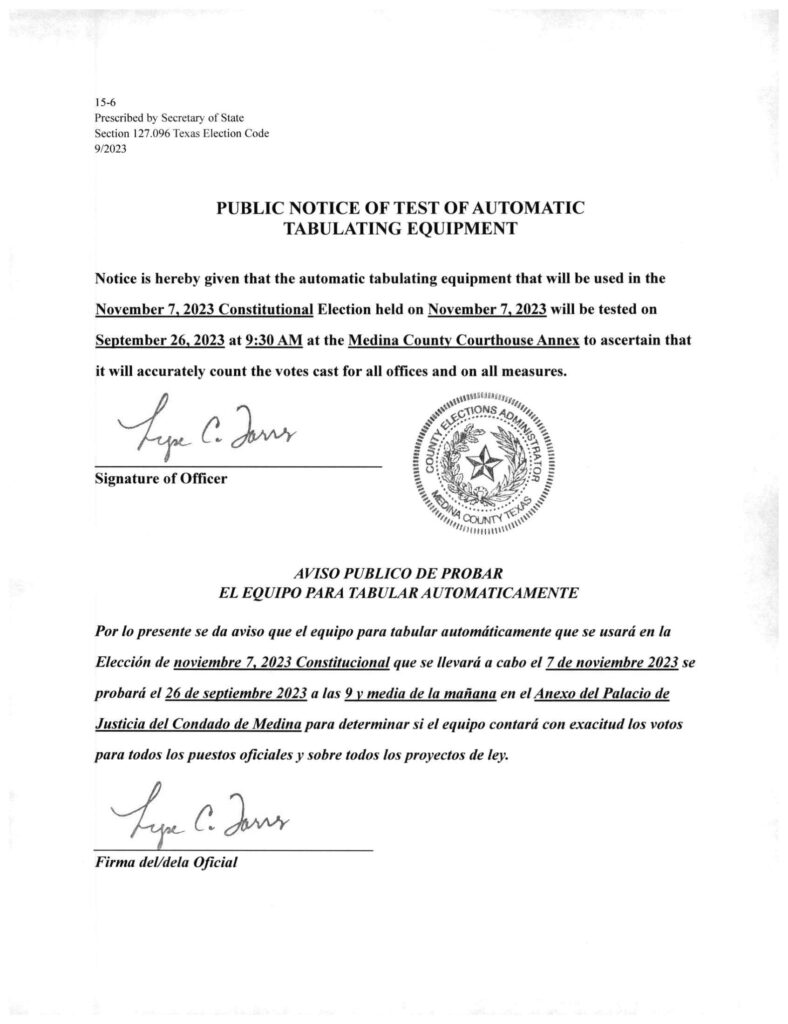

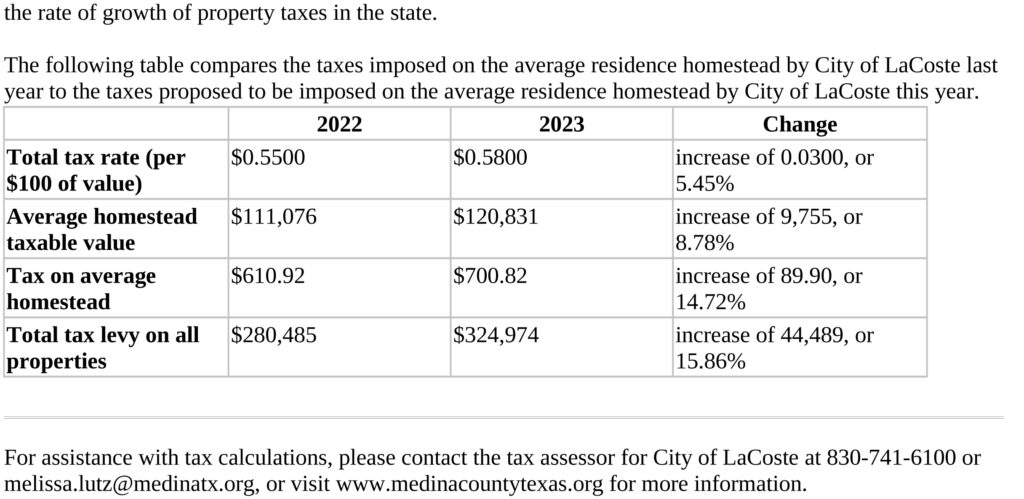

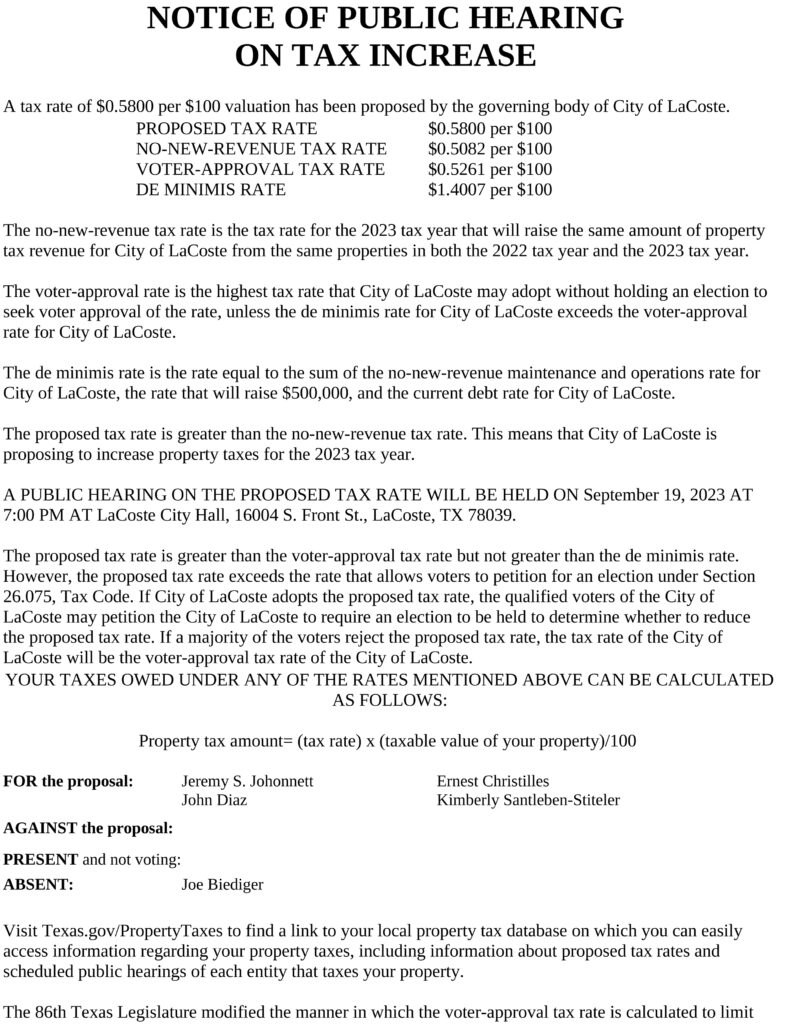

City of LaCoste Public hearing tax increase

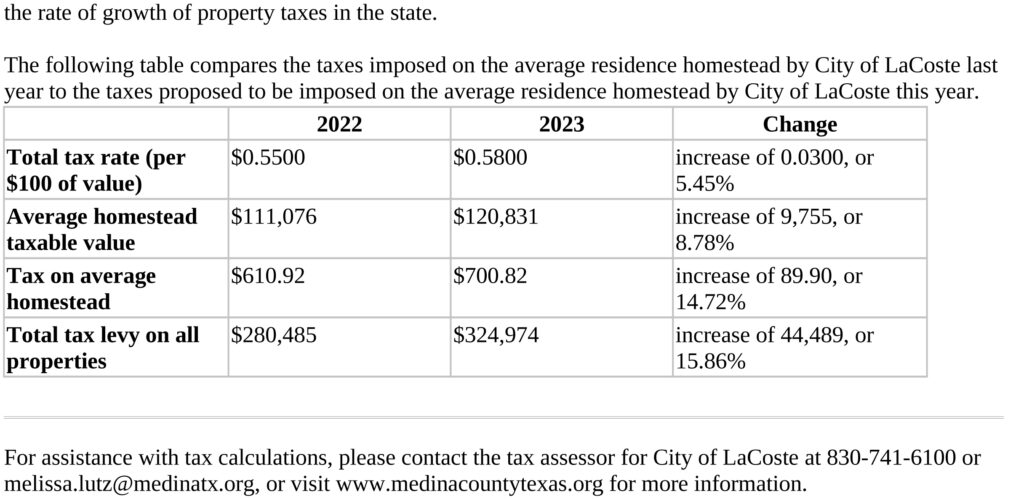

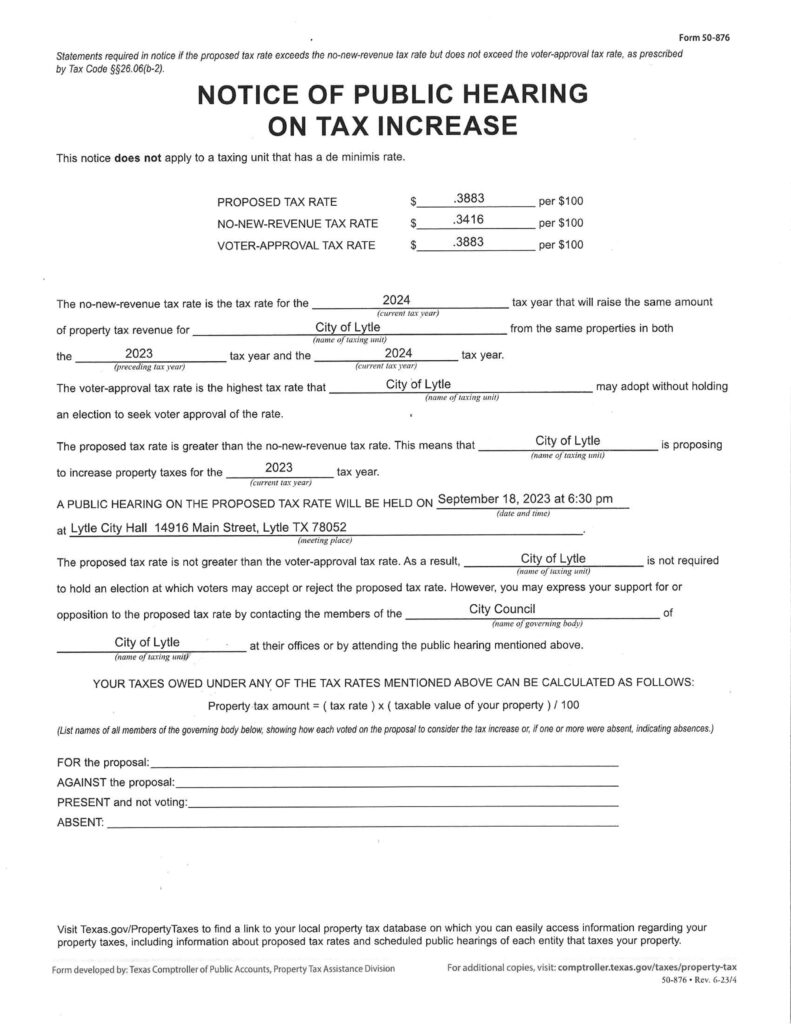

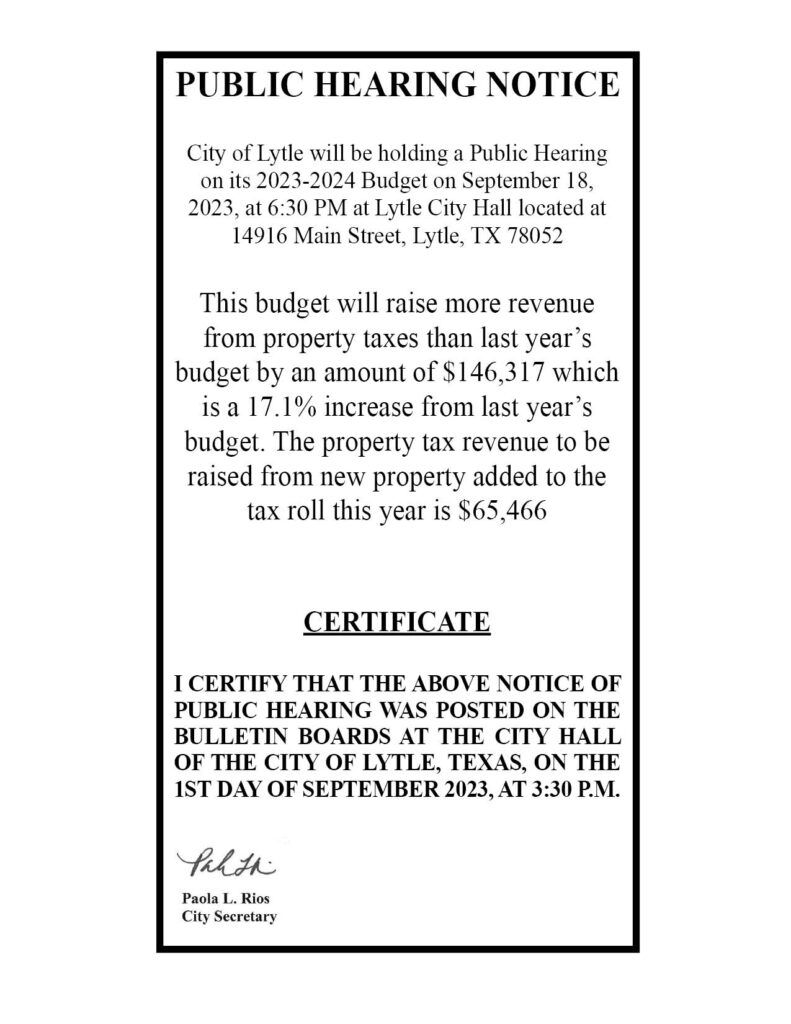

City of Lytle Public hearing tax increase

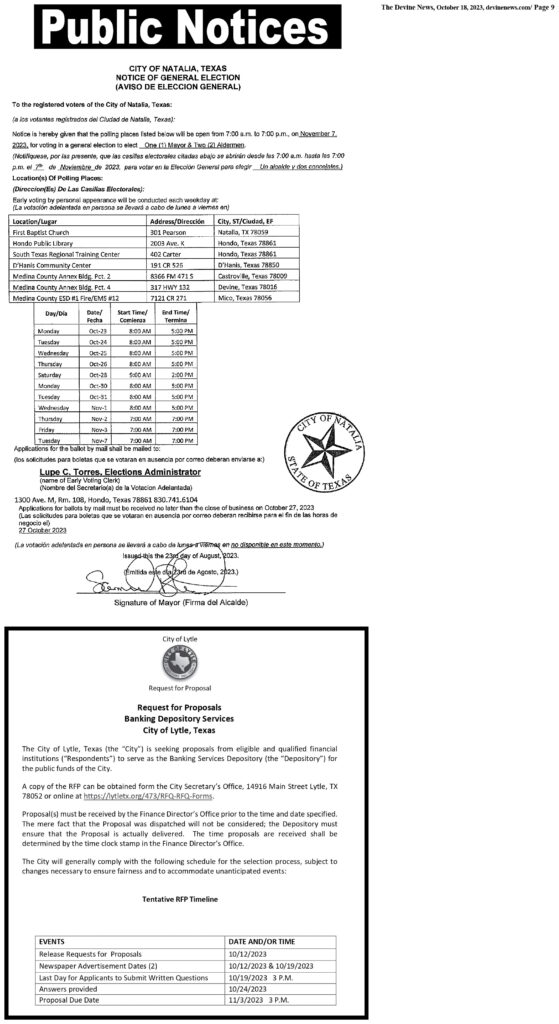

CITY OF NATALIA

NOTICE OF PUBLIC HEARING ON PROPOSED BUDGET

The City Council of the City of Natalia will hold a Public Hearing on Fiscal Year 2023-2024 Proposed Budget that has been filed.

THIS BUDGET WILL RAISE MORE TOTAL PROPERTY TAXES THAN LAST YEAR’S BUDGET BY $20,796 OR 6.01%. THE PROPERTY TAX REVENUE TO BE RAISED FROM NEW PROPERTY ADDED TO THE TAX ROLL THIS YEAR IS $21,112.

The Public Hearing is scheduled for September 18, 2023, at 6:45 pm, at City Hall Council Chambers, 2078 State Hwy 132 N., Natalia, Texas 78059.

The Proposed Budget was filed on August 18, 2023, in the City Secretary’s Office, and is available for public inspection in person or on the city’s website at http://cityofnatalia.com.

Posted/Published on September 6, 2023

By: Devine Newspaper

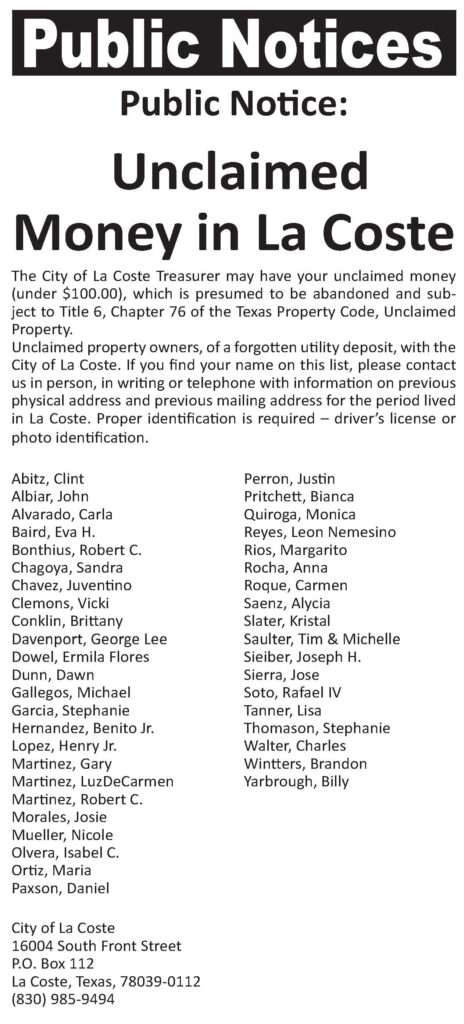

CITY of LACOSTE

BUDGET NOTICE OF PUBLIC HEARING

The City of La Coste will hold

a Public Hearing

Tuesday, September 19, 2023 at 7:00 p.m.

La Coste City Hall,

16004 S. Front Street

La Coste, Texas 78039

to consider the proposed Budget for Fiscal Year 2023 – 2024

A copy of the Proposed Budget is available for inspection at City Hall

For assistance, please contact the City of La Coste at 830-985-9494

or mail@cityoflacoste-tx.org

PUBLIC NOTICE

CITY COUNCIL OF THE

CITY OF LA COSTE

ORDINANCE 230815-02

Notice is hereby given that the City Council of the City of La Coste met in a Public Meeting on August 15, 2023, and has adopted an ordinance that revises, and/or re-affirms the location of stop signs within the City Limits of the City of La Coste. The Ordinance provides for AMENDING CHAPTER 72 TRAFFIC SCHEDULES, SCHEDULE II, PROVIDING FOR STOP SIGNS; AND PROVIDING FOR PENALTY.

Any violations are punishable by fine and/or imprisonment in accordance with State Law and as specified in the Ordinance.

A copy of the full ordinance may be obtained at the La Coste City Hall located at 16004 South Front Street, La Coste, Texas, 78039 during normal office hours.

Please publish in the Devine News on September 6, 2023

MEDINA COUNTY PUBLIC NOTICE

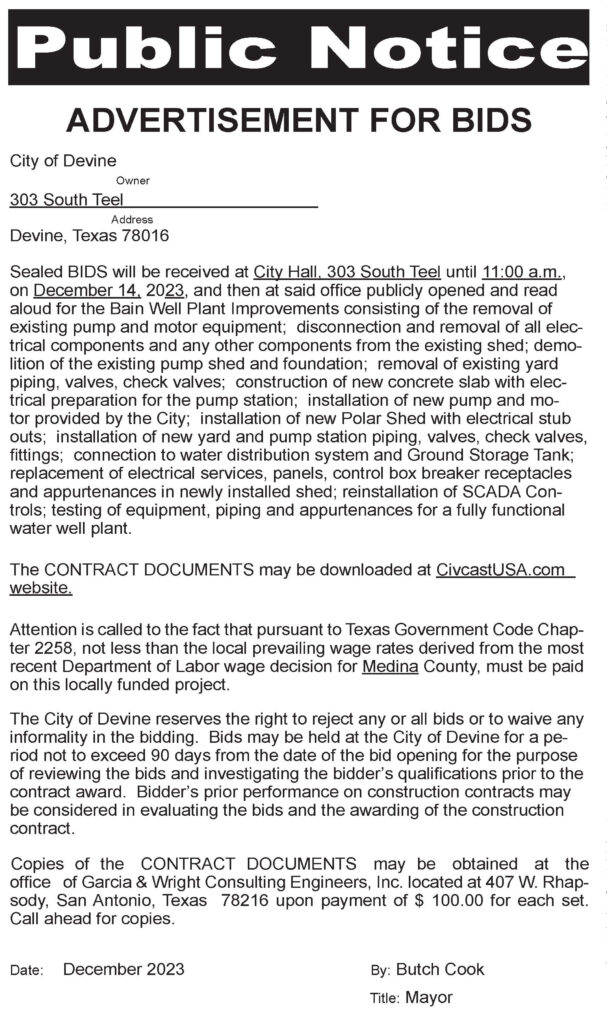

FY 2023 – 2024 SEALED BIDS for Medina County

Medina County Commissioners Court is seeking sealed bids for the purchase of County Precinct Paving services, County Precinct Hauling services, Countywide Fuels, Countywide Paving Oils, and County Precinct materials to include crushed base material, patching materials (coated aggregate & asphaltic), and paving rock (uncoated & pre-coated material).

Prospective bidders may obtain bid forms and specifications in person at the Medina County Courthouse Annex Auditor’s Office, 1300 Ave. M, Room 139, Hondo, TX 78861 (Hours of operation are M-TH 7:30 am-5:00 pm & F-8:00 am-12:00pm) or email us at purchasing@medinatx.org. You may also visit the Medina County website, www.medinacountytexas.org. All bid packets must be completely sealed and received at the County Auditor’s Office no later than Friday, September 15, 2023 at 10 am CST. Bids will be publicly opened and reviewed in the Auditor’s Office at 10:15 am CST. Commissioners Court will discuss and take possible action on this item during its regular scheduled meeting on Thursday, September 21, 2023.

Medina County reserves the right to accept or reject any and all bids.

Please feel free to contact us at (830) 741-6090.

Eduardo Lopez, Medina County Auditor

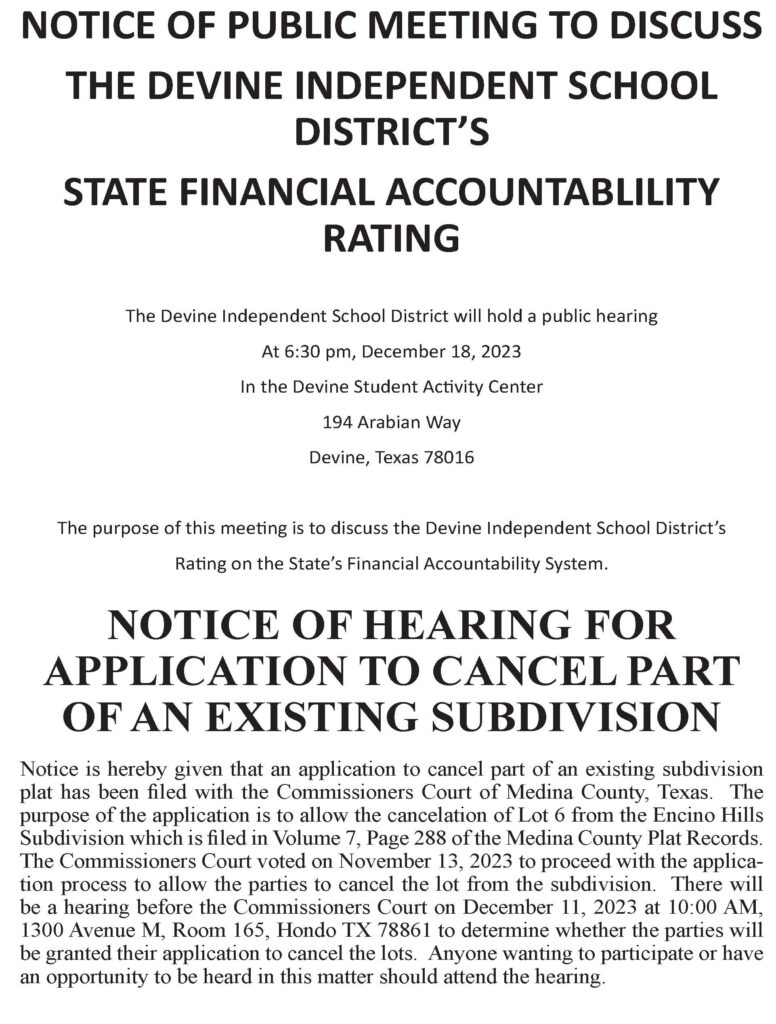

Notice of Public Hearing

Governing Body of The City of Devine

The City Council of the City of Devine, Texas will hold a Public Hearing on the Proposed Budget for the Fiscal Year 2023 – 2024 (October 1, 2023 through September 30, 2024) on the 12th day of September, 2023 at 6:00 p.m., at the Dr. George S. Woods Community Center, 200 E. Hondo Avenue, Devine, Texas 78016. A copy of said budget is on file in the office of the City Secretary at City Hall for inspection by any interested party.

All interested parties, groups or individuals are encouraged to attend this public hearing and participate in the discussion of the City of Devine’s 2023-2024

Budget. The City is wheelchair accessible. A request for accommodations and interpretive services must be made 48 hours prior to the meeting. For more information, please contact the City of Devine at (830) 663-2804.

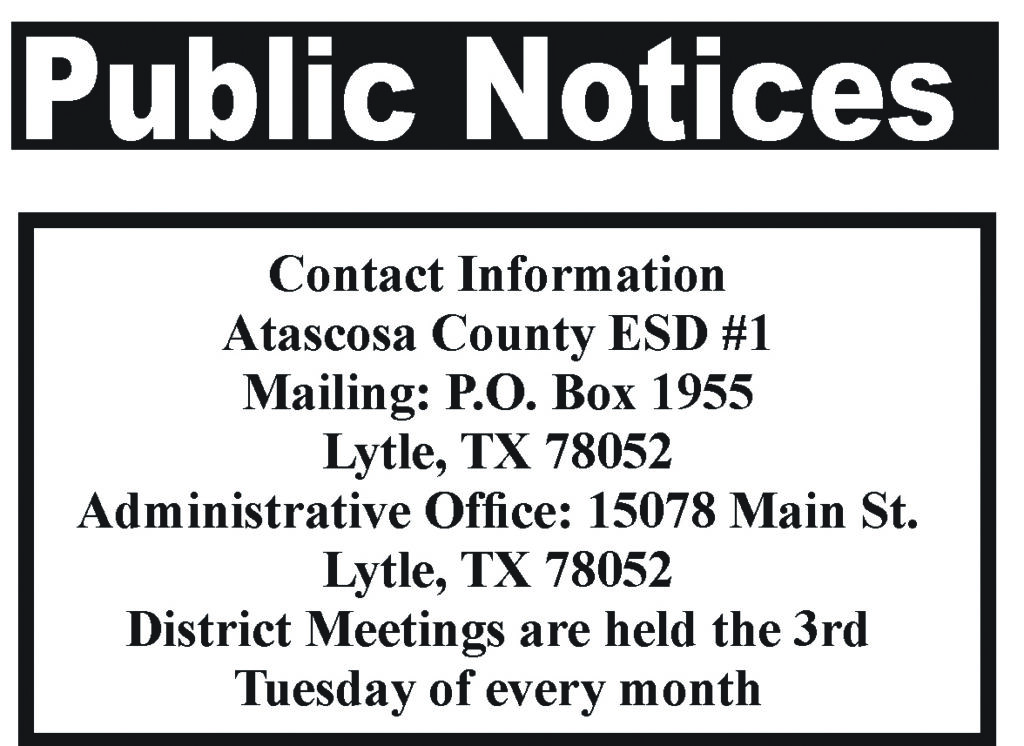

Atascosa County ESD #1 Small Taxing Unit Notice

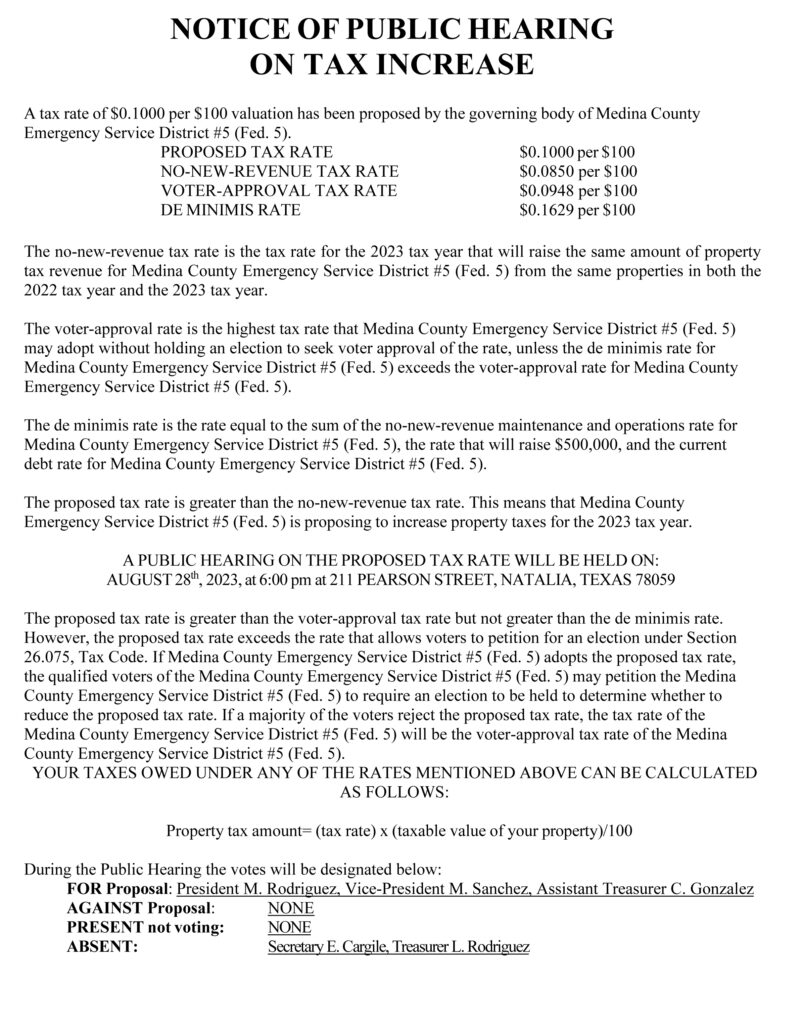

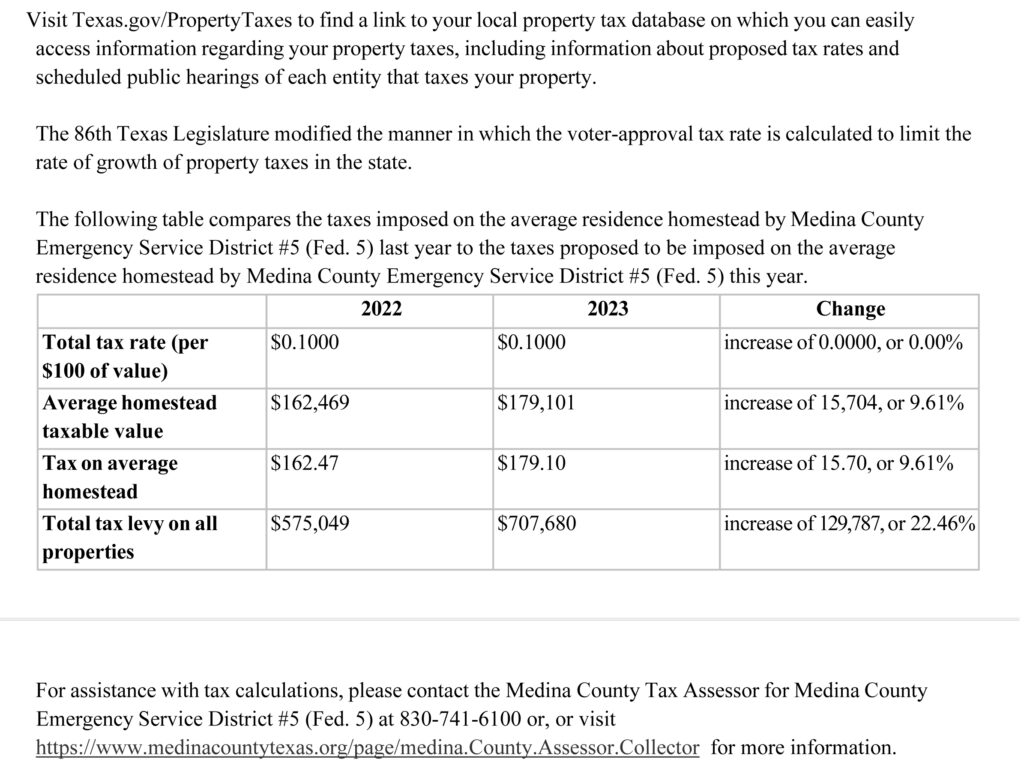

Medina County ESD #5 Tax Increase Public Hearing

NOTICE OF PUBLIC HEARING MEDINA COUNTY BUDGET (below)

Medina County Commissioners’ Court will hold a Public Hearing on the proposed budget for fiscal year 2023–2024 on Thursday September 7, 2023, 10:00 a.m. at the Medina County Courthouse Annex, Commissioners’ Courtroom, Room 165, Hondo, Texas.

This budget will raise more revenue from property taxes than last year’s budget by an amount of $2,271,399, which is a 9.53 percent increase from last year’s budget. The property tax revenue to be raised from new property added to the tax roll this year is $1,365,723.00.

The proposed budget can be viewed in the County Clerk’s Office 1300 Avenue M, Room 163, Hondo TX or online at www.medinacountytexas.org.

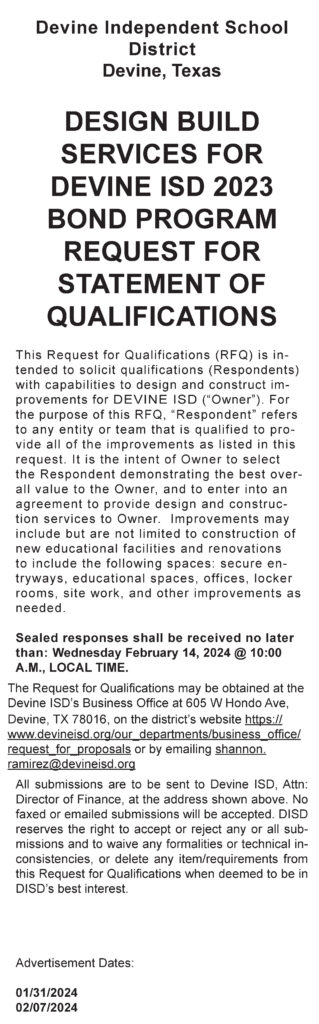

DESIGN – BUILD CONTRACTING FOR HIGH-PERFORMANCE FACILITIES REQUEST FOR QUALIFICATIONS

Medina County is seeking Request for Qualifications (RFQs) for Design-Build Contracting for High-Performance Facilities from interested and qualified firms for the development, design, build, and ongoing optimization of various facility projects. Copies of the Request for Qualifications are available electronically at http://www.medinacountytexas.org/page/medina.Bid.Notices or by contacting the Medina County Auditor’s Office by email at purchasing@medinatx.org.

Responses are due Thursday August 31, 2023 by 12:00 PM and to be sealed and addressed to the Medina County Auditor, Eduardo Lopez, with “Design-Build Contracting for High-Performance Facilities RFQ” clearly marked on the outside of the envelope or box. All RFQs may be mailed or hand delivered to 1300 Avenue M, Room 139, Hondo, TX 78861. Office hours are Monday-Thursday 8:00 am to 5:00 pm and Friday 8:00 am to 12:00 pm. The office is closed for lunch from 12:00 pm to 12:30 pm Monday-Thursday. Medina County will not accept responses submitted electronically. RFQs received after that time will be considered late and will be returned unopened. The County reserves the right to accept or reject any or all responses.

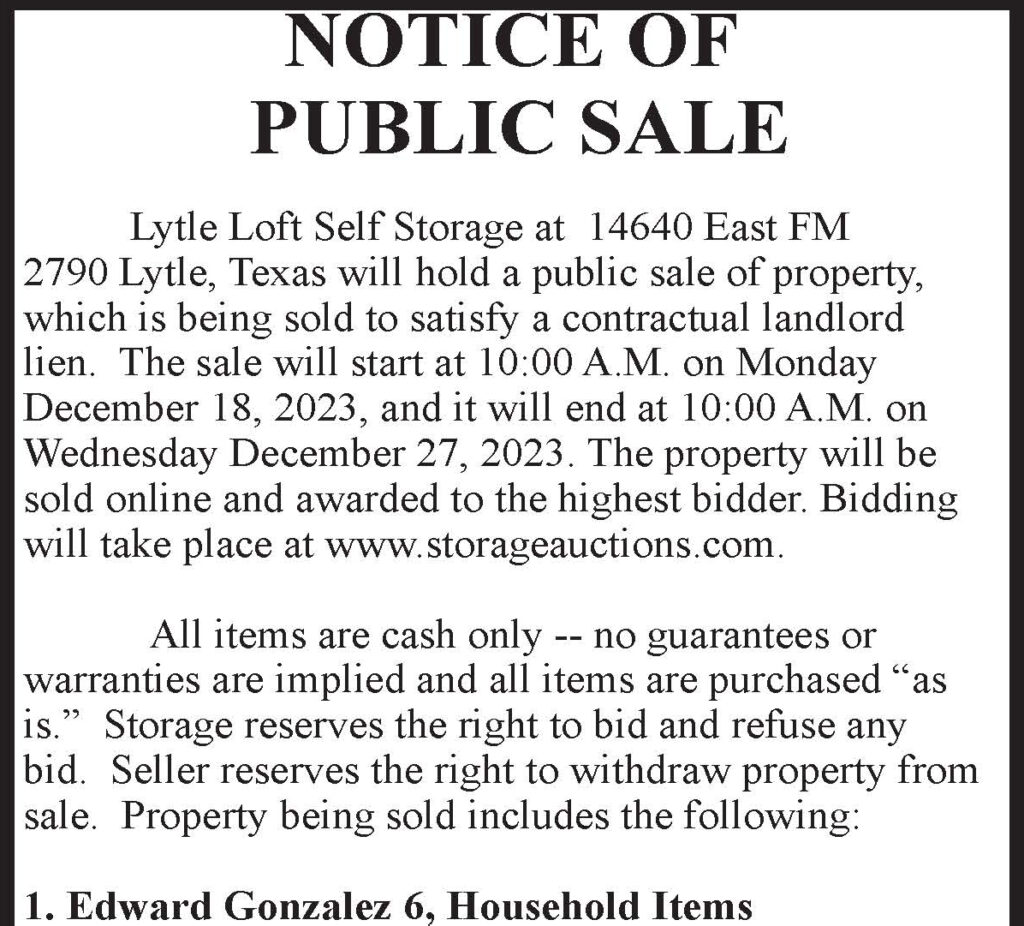

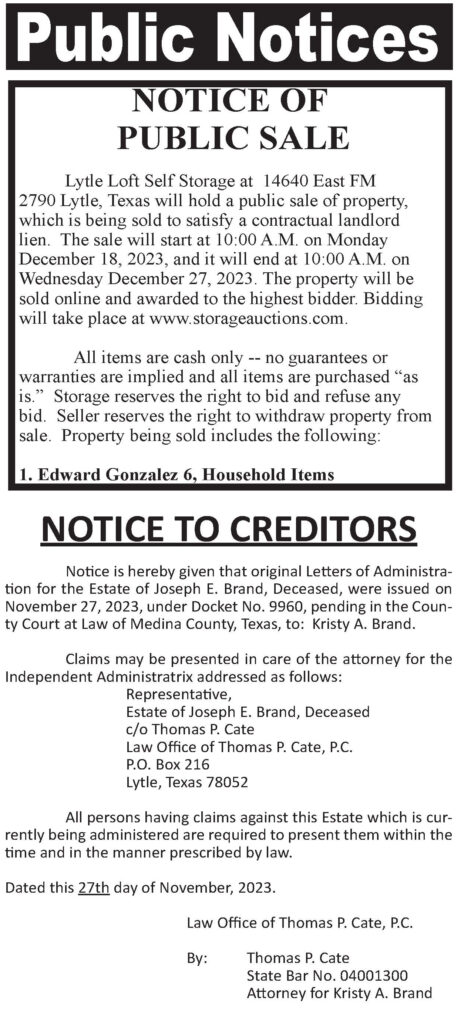

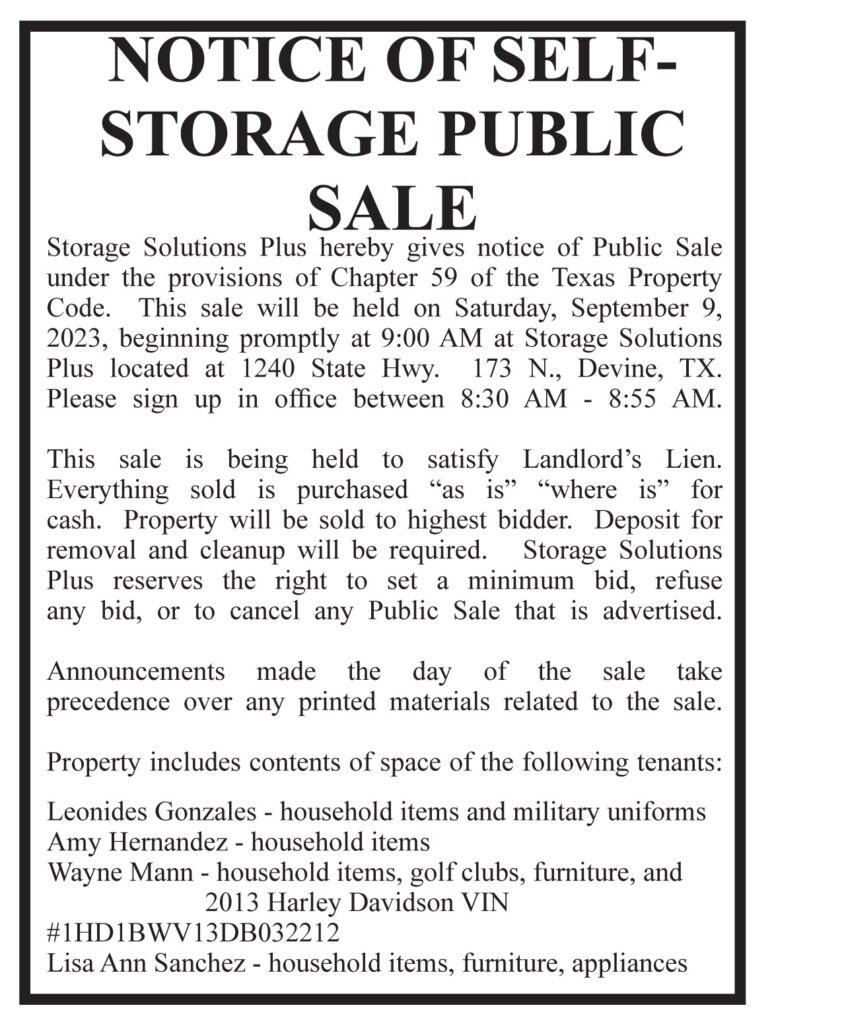

Notice of Self Storage Public Sale

*This Site is affiliated with Monumetric (dba for The Blogger Network, LLC) for the purposes of placing advertising on the Site, and Monumetric will collect and use certain data for advertising purposes. To learn more about Monumetric’s data usage, click here: <a href=’http://www.monumetric.com/publisher-advertising-privacy’>Publisher Advertising Privacy</a>*