By Anton Riecher

Medina County commissioners voted Monday to accept a $542,000 Federal Emergency Management Agency grant for flood mitigation assistance administered through the Texas Water Development Board.

On a motion by Precinct 3 Commissioner David Lynch, seconded by Precinct 4 Commissioner Danny Lawler, the commissioners voted unanimously to accept the funding for development of a county wide flood mitigation plan.

Category: Medina County Commissioner’s Court News

Important issues discussed at Medina County Commissioner’s Court.

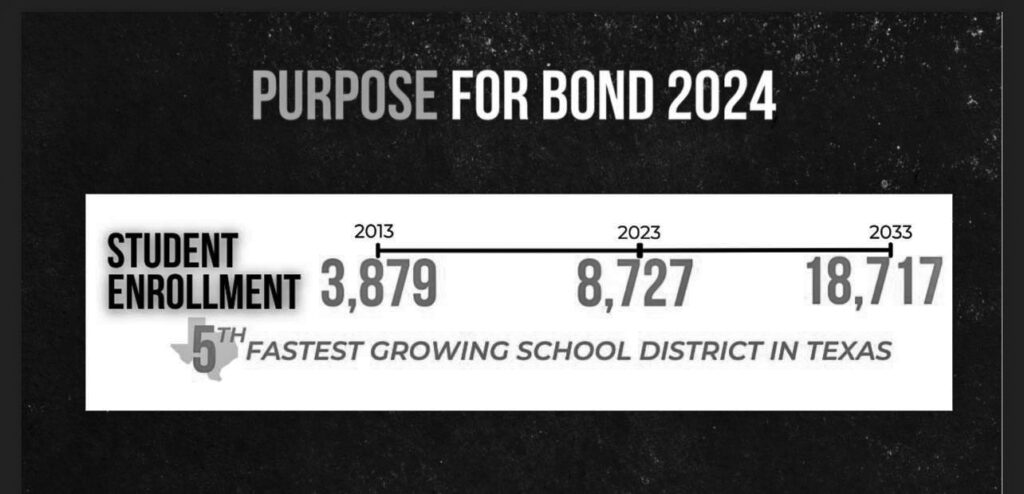

Voters face a mammoth $290 million bond issue in Medina Valley ISD

MVISD enrollment was at 3,870 just a little over 10 years ago, and is expected to explode to more than 18,000 within the next 10 years.

By Anton Riecher

In the Devine-Natalia-Lytle region, Medina County voters will decide on more than $54.4 million in bond issue proposals for their respective school districts this May. While certainly significant, that burden pales by comparison to what Medina Valley ISD alone is asking on its May ballot — $290 million.

MVISD board member Jason Bonney attributes the need to phenomenal expansion in enrollment experienced by the district.

“For the past few years we’ve had a crazy amount of enrollment and growth,” Bonney said. “We rank as the fifth fastest growing school district in Texas.”

The $290 million request comes only about a year after voters approved a $376 million bond issue for construction of a second high school and other district improvements, district superintendent Scott Caloss said in a video posted to the district’s website.

“In last year’s bonds we addressed the overcapacity at our high school,” Caloss said. “In this bond, we are having to address the capacities of our middle schools and elementaries.”

If approved, the new bond issue would cover the addition of a middle school and two elementary campuses, among other district improvements.

Medina Valley ISD covers 296 square miles of Medina and Bexar counties including the communities of Castroville, La Coste, Rio Medina, Dunlay and Mico. The district boasts more than 8,700 students distributed across eight campuses – five elementary schools, two middle schools, and one high school.

Despite the trumpeting of development along the Austin-San Antonio corridor, a generous amount of San Antonio’s metropolitan growth is moving west into Medina County. The county subdivision map displays an explosion of housing projects west of Loop 1604 bearing names such as Potranco West, Alsatian Oaks, Megan’s Landing and Hunter Ranch.

That expansion shows no sign of letting up. Only last March plans for a new $700 million subdivision between Castroville and San Antonio was announced. Add to this Microsoft’s new $1 billion data center just outside of Castroville and the result is a school district swamped by incoming families.

“Because the growth in the San Antonio-Bexar County area is so overwhelming the current middle schools and high school just cannot facilitate the number of students projected,” Bonney said. “We are projected to be at our maximum in our current middle schools and elementary schools by next year.”

As of 2023 district enrollment stood at 8,727 students, of which slightly more than 5,225 attend elementary schools. Even with a new elementary opening this fall, that attendance is expected to be over the district’s capacity by 2025-26. By 2028-29, elementary attendance is projected to reach 7,000 students.

The district’s middle schools, with slightly over 2,000 students in attendance, are also expected to be overcapacity by 2025-26. Middle school attendance is expected to hit 3,000 students by 2028-29.

Within a decade, total district enrollment is projected to swell by at least 1,000 new students, projections posted on the district’s website state.

While Texans continue to struggle with high property taxes, a key point in winning support for the MVISD bond issue is that no tax rate increase is tied to the latest bond proposal. Each new home sold increases the appraised value of the property it stands on, Bonney said.

The projection on population growth in the next few years stands at between 10 and 12 percent. That represents 14,000 new homes either…

TO CONTINUE READING…CLICK HERE or go to www.devinenewsmembers.com

Medina commissioners approve legal agreement to protect historic courthouse

By Anton Riecher

Medina County Judge Keith Lutz cast the tie-breaking vote Monday on whether the county would grant the Texas Historical Commission a “preservation easement” as a condition of receiving a courthouse preservation grant.

“In my opinion we are putting another person at the table with us when it is time to make decisions about the courthouse,” Lutz said.

In March Medina County commissioners unanimously approved the intermediate step in a three-phase program to qualify for a potential $10 million in state funding to renovate the county courthouse in Hondo. That application was submitted to the THC April 5.

As part of that application the THC is asking the commissioners to grant…

TO CONTINUE READING…CLICK HERE or go to www.devinenewsmembers.com

HANK and SJRC connection

By Anton Reicher and Kayleen Holder

In business discussed at Medina County Commissioner’s Court, it was announced that St. Jude’s Ranch for Children (SJRC Texas) will take the reins of property owned by HANK, Inc., a charity established 14 years ago by John and Debbie Southwell to provide food, clothing and shelter for hundreds of local foster children.

Application for courthouse renovation grant moves forward in Hondo

By Anton Riecher

Medina County commissioners unanimously approved the intermediate step in a three-phase program to qualify for a potential $10 million in state funding to renovate the county courthouse in Hondo.

“We are getting ready to submit our plan to the Texas Historical Commission,” County Judge Keith Lutz told the commissioners during their regular meeting Monday.

Gabriela Fierro with McKinstry Company, LLC, experts on maintaining government buildings, presented details on the timetable to meet the May 13 deadline to apply for the Texas Historic Courthouse Preservation Program.

“We had a really successful meeting last week in Austin at the THC,” Fierro said. “This was the time for us to go through the first stage of draft plans with…

TO CONTINUE READING…CLICK HERE or go to www.devinenewsmembers.com

Emergency Repairs to bridge approved this week

By Anton Riecher

Medina County Commissioners voted unanimously Oct. 5 to approve $264,000 in discretionary funds for the emergency repair of the County Road 5723 bridge crossing the Medina River near Castroville, recently closed due to extensive damage.

“Obviously, one of the biggest concerns to us is safety,” County Judge Keith Lutz said. “We know this is a safety concern.”

On a motion by Precinct 3 Commissioner David Lynch, seconded by Precinct 4 David…….. READ MORE by becoming a subscriber at www.DevineNewsMembers.com

Up for election in 2024…10 Medina County positions on the ballot next year, Deadline for candidates to file is December 11th, 2023

There are eight Medina County officials whose terms will expire in December 2024, but the deadline to file for these offices is this December 11, 2023.

-Sheriff of Medina County Randy Brown

-Tax Assessor/Collector of Medina County Melissa Lutz

-454th Judicial District Judge Daniel Kindred

-Criminal District Attorney Mark Haby

-PCT 1 County Commissioner Jessica Castiglone

-PCT 3 County Commissioner David Lynch

-Constable Pct 1 Robert Tschirhart

-Constable Pct 2. Jim Przybylski

-Constable Pct. 3 Steven Duffy

-Constable Pct. 4 Malcolm Watson

The filing dates to be on the ballot in 2024 are from November 11, 2023 to December 11, 2023. All local candidates are to file with their respective Party Chair’s Office. Name, phone number and email address is listed on the candidate filing information on our website.

A complete list of local positions in Medina County showing the expiration dates of terms can be seen at: https://www.medinacountytexas.org/page/medina.Elections > Internet Posting Requirements > Candidate Filing Information.

County Treasurer Debbie Southwell retires

Medina County Treasurer Debbie Southwell gave her letter of retirement to Commissioner’s Court this past Monday. Her retirement will take effect October 31, according to County Judge Keith Lutz.

“There is a small window of time if anyone wants to file for election from November 11-December 11 if anyone wants to run for Treasurer,” Judge Lutz said.

In the mean time, Judge Lutz adds, “We (commissioner’s court) will appoint someone to the position, but it will be on the November ballot again very soon. And unlike other elections, the newly elected treasurer would take office immediately after votes are canvassed.”

In her letter of resignation addressed to County Commissioners Jessica Castiglione, Danny Lawler, David Lynch and Larry Sittre as well as Judge Lutz, Mrs. Southwell stated:

“It has been a pleasure serving the people of Medina County, and I have gained valuable insight into the inner workings of county government. I wish all of you the best of luck in the future and pray that Medina County continues to grow and thrive.”

Medina County to collect $2Million more in taxes at new tax rate

By Jerry Beck

On September 7, the focus of the Medina County Commissioners Court session was on Employee raises, the Tax Rate and the 2023-24 Budget.

The current tax rate for Medina County is $0.4743 per $100 evaluation. The rate that was approved was $0.4356 per $100 evaluation.

Continue reading “Medina County to collect $2Million more in taxes at new tax rate”

Medina County to collect $2 Million more in property taxes at new tax rate

By Jerry Beck

On September 7, the focus of the Medina County Commissioners Court session was on Employee raises, the Tax Rate and the 2023-24 Budget.

Continue reading “Medina County to collect $2 Million more in property taxes at new tax rate”