Devine ISD has two seats up, Feb. 13 deadline to sign up

District 3 held by Henry Moreno and District 4 Board President held by Nancy Pepper are up for election. The deadline to file application for place on the ballot is 5:00 p.m. on February 13, 2026.

As of Tuesday, January 27, Incumbant Nancy Pepper has signed up for re-election to District 4.

Britny Stricker filed for the District 3 position.

Both are district seats but open to any qualified resident of Devine ISD.

Any qualified candidate can run for either district seat, but only the voters that live within district 3 or district 4 can vote in their district’s race.

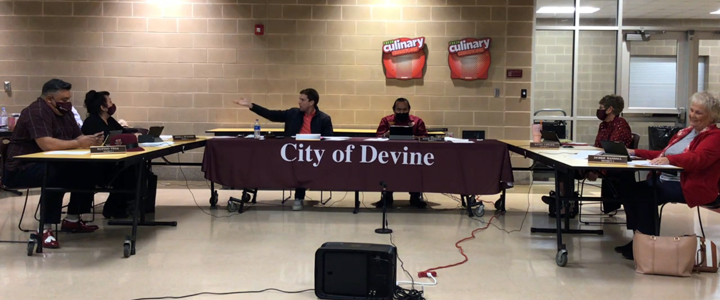

City of Devine

The 2026 General Election for the City of Devine will be held on Saturday, May 2, 2026.

Seats that will be on the ballot include those held by Ray Gonzales ( District 1 councilman), Jeff Miller (District 3 councilman), and Josh Ritchey (District 4 councilman–who recently resigned). These positions expire in May 2026. The filing period to be placed on the ballot starts January 14, 2026 and ends February 13, 2026.

Mayor and 3 council seats up election, deadline to file is February 13

The Mayor and three council seats, District 1, 4 and 5 are up for election on Saturday, May 2, 2026. Only one application has been filed so far to be on the ballot, that of Michael Vasquez for the District 1 position.

The filing period for a place on the ballot ends February, 13, 2026. Applications are available at city hall.

Currently representing the City of Lytle are Ruben Gonzalez as the Mayor, Michael Rodriguez as the Alderman for District 4 and Matthew Martinez as District 5.

The District 1 position is on the ballot also because of a vacancy, but it will be for only a one year term. The others are normal two year terms.

Lytle ISD

Lytle ISD school board elections are conducted in May each year. During this election cycle, two Single Member Districts are up for election:

Single Member District 3 – Incumbent: Bobby Sollock

Single Member District 4 – Incumbent: Eva Burley

The deadline to file an application for a place on the ballot is February 13th at 5:00 p.m. The deadline to declare write-in candidacy is February 17th at 5:00 p.m.